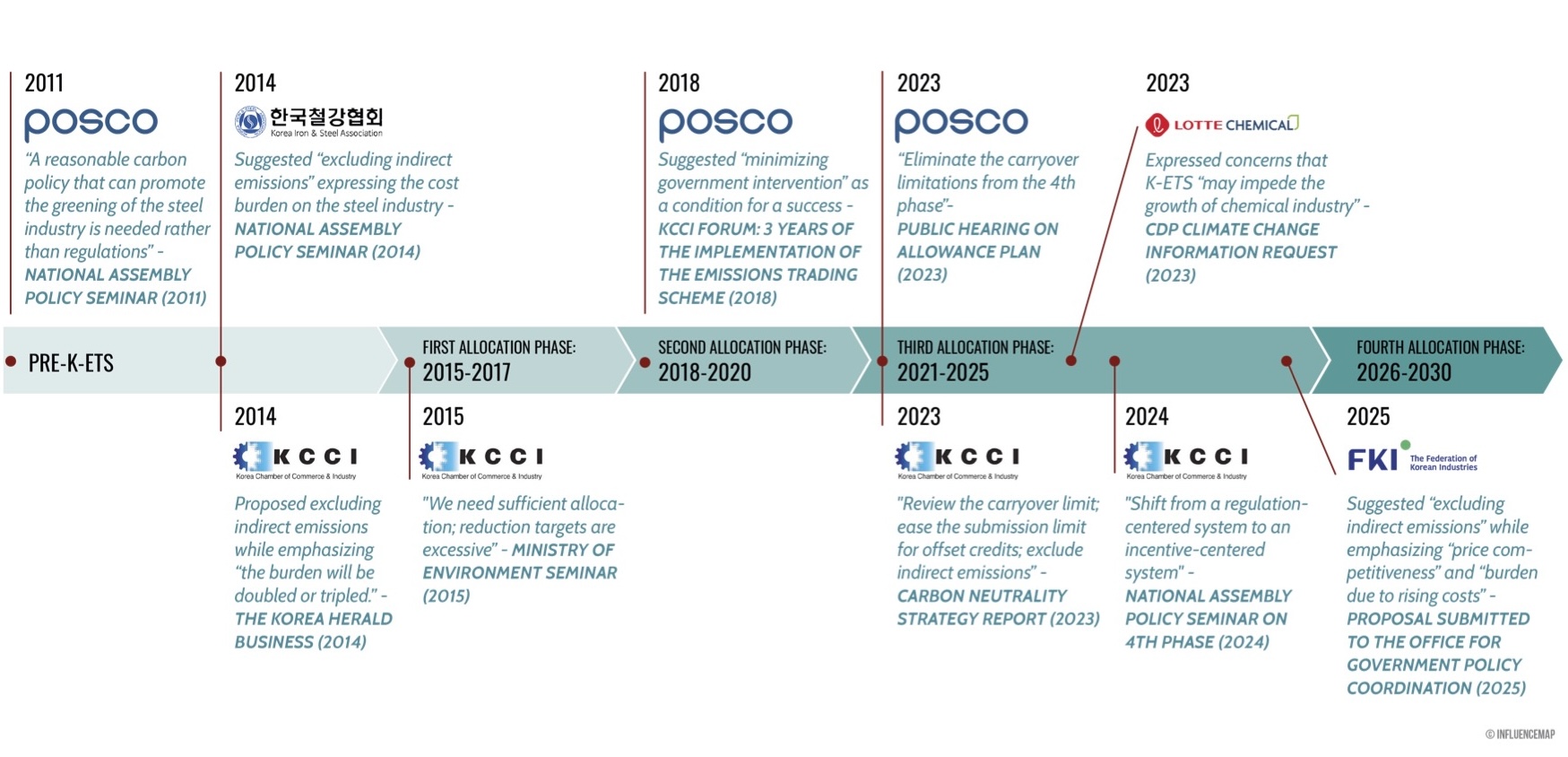

New analysis from InfluenceMap has revealed that major corporate actors, particularly the steel industry and large cross-sector industry associations, appear to have played a leading role in weakening the Korea Emissions Trading Scheme over the past 15 years—posing serious risks to the nation’s climate commitments and green transition. The analysis covers 234 instances of corporate climate policy engagement over this time, undertaken by 25 companies and 11 industry associations in South Korea. It highlights the outsized role of heavy-emitting sectors—led by the steel sector, represented by POSCO, and cross-sector industry associations such as the Korea Chamber of Commerce and Industr (KCCI)—in shaping the K-ETS policy in ways that reduce its ambition and effectiveness.

The report uses InfluenceMap’s evidence-based methodology, which benchmarks corporate influence against government’s policy ambition and Intergovernmental Panel on Climate Change (IPCC) pathways to 1.5°C. It shows that cross-sector industry associations account for 36% of all engagement on the K-ETS, followed by the steel sector (20%), chemical sector (11%), and energy (oil & gas) sector (8%). These four actively engaged sectors comprise over 75% of the engagement with the K-ETS, while other sectors have shown only marginal engagement. Additionally, the more actively a sector engaged with the K-ETS policy, the more negatively it engaged, advocating for measures such as increased free emission allowances, exclusions of indirect emissions, looser offset rules, and eased carryover limits.

Highly engaged entities have framed the K-ETS as a burden on industry and stressed the need to protect competitiveness in trade-exposed sectors. These positions run counter to strengthening the carbon price and undermine the scheme’s core objectives: reducing emissions cost effectively, driving innovation, and positioning South Korea as a climate leader.

For instance, KCCI, the entity most actively engaged on the K-ETS, did not support the K-ETS in its current form and advocated for an incentive-based system rather than a regulation-focused approach at a September 2024 National Assembly policy seminar on the 4th plan period of the K-ETS. At a Public Hearing on the Amendment to the Third Allowance Plan hosted by the Ministry of Environment in September 2023, POSCO called for the “elimination of carryover limitations” in the Fourth Allocation Phase.

Since its launch in 2015, the K-ETS has undergone three Allocation Phases. InfluenceMap’s findings show that sustained industry pressure has likely contributed to weakened policy outcomes:

The K-ETS remains South Korea’s flagship climate policy instrument and is expected to undergo further revisions ahead of the country’s updated Nationally Determined Contribution (NDC), to be presented at the COP30 climate summit in Brazil. However, persistent opposition—particularly from industrial incumbents—poses a significant risk to achieving South Korea’s Paris Agreement targets. This opposition also undercuts economic opportunities in sectors that stand to benefit from a strong carbon price, such as electric vehicles, renewable energy, and battery storage. A weakened K-ETS reduces incentives for innovation and investment in the country’s green economy.

While these four sectors account for over 75% of K-ETS policy engagement, others—including automakers, information technology, and telecommunications—have been largely absent from the conversation. As the Fourth Allocation Phase approaches, companies in technology, retail, business services, and finance are expected to take a more active role. This includes amplifying their perspectives within industry associations such as the Korea Chamber of Commerce and Industry (KCCI) and the Federation of Korean Industries (FKI), which have so far shown limited support for a science-aligned K-ETS.

Sejin Lee, Korea Program Manager at InfluenceMap said

Our research shows a clear trend: for over a decade, South Korea’s flagship climate policy—the K-ETS—appears to have been weakened by the influence of heavy-emitting industries and powerful associations, notably the steel sector and cross-sector associations like the KCCI. This persistent corporate influence has coincided with a sharp drop in the K-ETS’s ambition and effectiveness, slowing progress on South Korea’s green transition. As the country prepares to revise its climate targets ahead of COP30 in Brazil, it is vital to curb this obstructive influence but also to have corporate input into the K-ETS from a broader range of sectors, including finance, business services, automotive, renewables, and battery technology. These industries depend on a stronger carbon price to thrive in global low-carbon markets.

Dr. Daehyun Cho, Korea Program Manager at Asia Investor Group on Climate Change, said

While the impact of the K-ETS has been limited to date due to issues such as over-allocation of emissions allowances to companies, it remains a crucial tool for South Korea’s net-zero transition. We hope to see more constructive engagement that supports a stronger K-ETS from various stakeholders, as this will be key to reducing transition risks and building investor confidence in South Korea’s low-carbon future.

Kitty Hatchley, Media Manager, InfluenceMap (London)

Email: kitty.hatchley {@} influencemap.org

Sejin Lee, Korea Program Manager, InfluenceMap (Seoul)

Email: sejin.lee {@} influencemap.org