See coverage in Renew Economy

New analysis of corporate engagement with the Future Made in Australia (FMIA) plan reveals growing support for climate policy from key sectors across the Australian economy in recent years. The FMIA plan is a policy package which commits over $22 billion AUD of public funding over ten years to support Australia's transition to a net-zero economy. It aims to spur private investments in clean energy manufacturing to aid the country's net zero transition through investments in renewable hydrogen, green metals, low carbon liquid fuels and clean energy manufacturing. Due to the scale of financial support on offer, the FMIA plan is the subject of intensive advocacy by corporate interests. As the current opposition Liberal/National Coalition alliance was critical of the FMIA plan during its development, there is a risk that the policy could be repealed or modified if the Coalition form a majority government after the Federal Election due to be held on May 3rd 2025. This would impact Australia's ability to achieve its emissions goals.

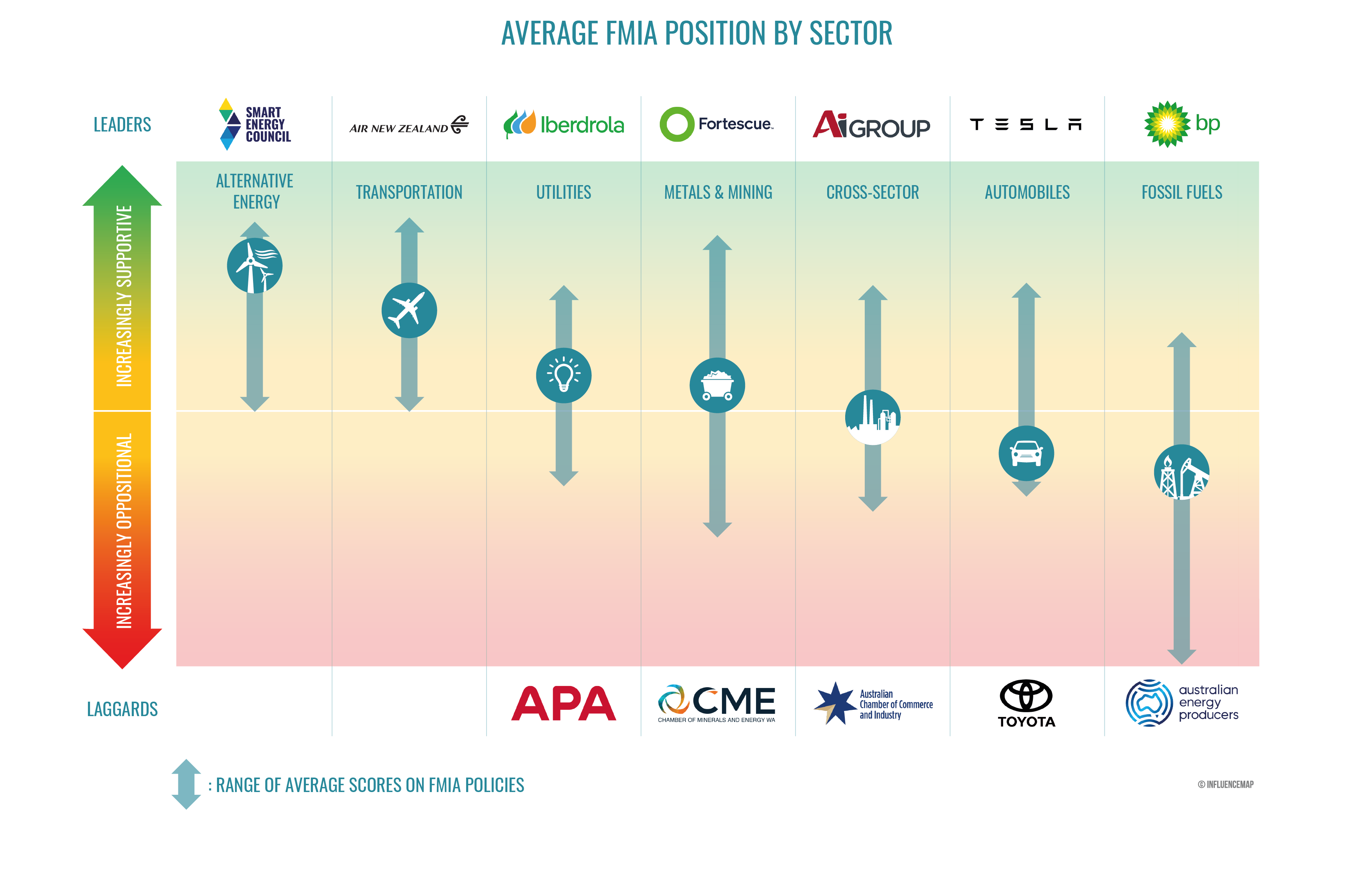

InfluenceMap analyzed 185 consultation responses from 58 companies and industry associations on eight separate policy measures included under the FMIA, finding roughly half (47.5%) to be supportive of the climate measures in the FMIA, and around a quarter (28%) displaying oppositional positions. The most positively engaged company across the analysis of the eight policies was Fortescue, with the Smart Energy Council as the most positive industry association overall. In contrast, companies (Chevron, ExxonMobil and Toyota) and industry associations (Australian Energy Producers) representing the fossil fuel and automotive sectors held mostly negative positions, though engagement from the fossil fuel production sector was significantly higher than that from the automotive sector. While the consultation responses examined by InfluenceMap are in the public domain, it is likely that significant advocacy and lobbying has been and will be occurring behind closed doors with the most intensive activity reflective of the groups that both support and oppose the Future Made in Australia (FMIA) plan in its current form.

This represents a higher level of support for climate-related policy in Australia from corporates compared to InfluenceMap’s analysis from 2024 which found that only 35% of Australia’s leading companies and industry associations advocated supportive positions on federal climate and energy-related consultations during Labor’s first year in office. Support for key policies was strong from sectors which have historically not engaged positively with climate-related legislation in Australia, including metals and mining, transport (excluding automobiles), and utilities. The high-level of corporate engagement likely reflects the design of the FMIA, which focuses on enabling the energy transition through financial and strategic support rather than regulatory constraint. Nonetheless, there was significant support for the ambition of the FMIA and the focus on renewable energy, critical minerals and decarbonization.

InfluenceMap's analysis detected limited corporate support for the introduction of nuclear energy in Australia compared to the support for the FMIA. According to LobbyMap's holistic assessment, most companies and industry associations that endorsed the introduction of nuclear energy in Australia have policy positions that are otherwise misaligned with science-aligned climate policy (e.g. on the need to phase out fossil fuels) and took unsupportive positions on the FMIA including the Minerals Council of Australia and the Chamber of Minerals and Energy of Western Australia (CME). Opposition to the introduction of nuclear energy in Australia came from companies and industry associations that hold science-aligned positions on wider climate-related policy including Fortescue and the Clean Energy Council.

According to the Climate Change Authority (CCA), a nuclear-led pathway would lead to Australia missing its greenhouse gas targets in 2030 and 2035, and result in an estimated equivalent of 2.6°C of warming, far above the Paris Agreement target, partly due to the knock on effect of extending the role of coal-fired power generators.

Cross-sector industry associations appear to be less supportive of the FMIA than many of the companies they represent. Despite the Ai Group communicating support for the plan, the Business Council of Australia was highly engaged with both positive and negative positions, while the Australian Chamber of Commerce and Industry appeared unsupportive overall.

We know how important limiting warming in line with the Paris Agreement’s goals is for our economy, for our investments, and for our businesses, and we know we will need policy to get us there. It is imperative that businesses engage with climate policy to support the transition and to act in a way which is consistent with their publicly stated commitments.

Though there continues to be obstructive lobbying from legacy industries who stand to benefit from delay, it’s encouraging to see this analysis from InfluenceMap which indicates that a growing number of businesses are engaging in support of policies that provide a pathway for Australia to reduce emissions. Now is the time for us to go further, and to ensure meaningful direct engagement from across our economy extends beyond the Future Made In Australia Plan to climate policy in Australia more generally in this critical decade

Sector icons indicate the average FMIA position for each sector, while arrows show the range between the most positive and most negative entities on average within that sector. Leaders are the most positive entities across FMIA-related policies in their sector, while Laggards are the most negative. To be identified as a Leader or Laggard, an entity must have engaged with at least two FMIA-related policies covered in this briefing.

The Australian Federal Election is due to be held on May 3rd 2025, with energy and climate change shaping up to be key issues due to the sharp focus on the cost of living and affordability. Since the last federal election in May 2022, there has been an increase in the number of climate and energy-related policies under consideration, with 21 new federal-level policies being tracked on InfluenceMap’s Australia Platform. Eight of these have come from the government’s FMIA. The plan, first announced in April 2024, is a policy package of new and existing measures which aims to support Australia’s transition to a net-zero economy through over $22 billion AUD worth of support measures including tax credits, subsidies and other government support measures. Several consultations were opened to engage with Australian companies and industry associations on the proposed support measures in 2023 and 2024. On the 28th November, Labor and the Greens reached a deal that allowed Labor’s legislative agenda to move forward, and in return Labor committed to excluding support for fossil fuels through FMIA polices.

InfluenceMap has tracked corporate engagement on eight FMIA-related policies on dedicated policy pages as part of its Australia platform :

| Policy and link to analysis | Details |

|---|---|

| Future Made in Australia Bill 2024 | Establishes the legislative foundation for public investment in industries crucial to achieving Australia’s climate targets. It expands the powers of agencies like Export Finance Australia and Australian Renewable Energy Agency (ARENA) to finance projects in renewable energy, green industry, and critical minerals. |

| Hydrogen Headstart program | Provides funding to support early-stage renewable hydrogen projects, helping grow Australia’s clean hydrogen industry. |

| Review of the National Hydrogen Strategy | Updates Australia’s hydrogen strategy to ensure it aligns with emerging technologies, market trends, and decarbonization goals. |

| Hydrogen Production Tax Incentive | Offers tax credits to reduce the cost of producing renewable hydrogen, making clean hydrogen more competitive with fossil-based alternatives. |

| Critical Minerals Production Tax Incentive | A tax incentive aimed at encouraging investment in the extraction and processing of critical minerals essential for clean energy technologies, such as lithium and rare earth elements. |

| Unlocking Green Metals Opportunities | Focused on boosting Australia’s capacity to produce low-carbon metals, such as green steel and aluminum, by leveraging renewable energy. |

| Unlocking Australia’s Low Carbon Liquid Fuel Opportunity | Aims to develop sustainable liquid fuel alternatives to cut emissions in hard-to-abate sectors like aviation, shipping, and heavy-duty road transport. |

| Australia’s Guarantee of Origin Scheme | Creates a national system to track and certify the use of renewable energy in products like hydrogen, ensuring emissions transparency for domestic and export markets. |

On June 19th 2024, the opposition Coalition announced its policy on nuclear energy ahead of the 2025 election, in which it criticized Labor’s “renewable-only approach” and instead stated that a Federal Coalition government would introduce nuclear energy in Australia, proposing seven locations where nuclear power stations can be built. At the same time, the Coalition expressed opposition to Labor’s FMIA plan. In September 2024, Coalition senators published a dissenting report in response to the Senate Inquiry into the Future Made in Australia Bill, which stated that the plan is “highly flawed”, defended the party’s nuclear energy plan, and recommended that the Bill should not pass. As a result, if the Coalition achieves a majority government following the election there is a risk that the Future Made in Australia Act may be repealed or modified in a way which impacts the ability of the FMIA to help Australia achieve its emissions goals.

The Coalition has also communicated further support for the role of fossil gas. On the 27th March, the Coalition leader, Peter Dutton, announced that a Coalition government would allow fossil gas to be included in the Capacity Investment Scheme, something which the Australian fossil fuel sector has repeatedly called for. The scheme is currently designed to specifically incentivize renewable energy projects in Australia. He also announced there would be an additional $1bn AUD for gas infrastructure and on the 2nd April, the Coalition outlined plans to include fossil gas as a critical mineral, qualifying the fuel for funding under the FMIA, contrasting with Labor’s commitment to not support fossil fuel projects through the FMIA.

The Climate Change Authority (CCA) is an independent body of experts that provides advice to the Australian Government on climate-related policy. On February 24th 2025, the CCA released new analysis on the climate impacts of a nuclear-led decarbonization pathway in Australia, finding that such a pathway is consistent with warming of around 2.6 °C, therefore not achieving the temperature goals set at the Paris Agreement. The CCA also determined that the pathway would lead to Australia missing its 43% greenhouse gas emissions target for 2030 and 2035. Crucially, it found that the pathway would lead to an additional 1 billion tons of emissions from the electricity sector by extending the life of coal-fired generators. Instead, the CCA recommended that Australia stay on its current course of supporting renewable energy generation, storage and firming at pace.

Australia’s climate policy landscape has expanded significantly since the 2022 federal election, with the current government advancing a renewables-led approach through initiatives such as the Future Made in Australia (FMIA) plan. In contrast, the federal opposition has signaled a potential pivot to a nuclear-led strategy if elected. Both major parties' respective energy plans are backed up by a continued role for fossil gas, with Labor's Future Gas Strategy and the Coalition's National Gas Plan projecting an expanded role for fossil gas that is misaligned with IPCC guidance on the global use of fossil gas in 1.5°C pathways. Against this backdrop, understanding the position of corporate Australia is critical.

This briefing utilizes InfluenceMap’s database of 700+ companies, including 47 of the largest companies headquartered in Australia, and 300+ industry associations and its established system for assessing these entities’ climate policy engagement (see the LobbyMap methodology for more details). It focuses on corporate responses to the FMIA, as tracked on InfluenceMap’s Australia Platform, to evaluate whether the plan has received broad business support. It also compares this to levels of support expressed for the Coalition’s proposed nuclear-led pathway, using submissions to the 2024 Inquiry into Nuclear Energy Power Generation in Australia as a case study.

InfluenceMap has assessed eight policy areas within the Australian government’s FMIA Plan. The analysis finds overall corporate support for the plan across key sectors of the economy. Of the 185 consultation responses assessed, 88 (47%) were supportive or strongly supportive of the government’s proposals across the eight policy areas, 51 (28%) were mixed or unclear, and 44 (25%) were unsupportive or oppositional. Support was strong from industries central to Australia’s economy, including metals & mining, transport (excluding automobiles), and utilities. In contrast, the fossil fuel and automotive sectors, along with several cross-sector industry associations, had mostly negative positions.

Several companies and industry associations engaged across multiple FMIA policies. As shown in the graphic, industry associations representing the alternative energy sector, including the Australian Hydrogen Council, Clean Energy Council, and Smart Energy Council were among the most engaged industry associations. Fortescue was the most engaged company, followed by fossil fuel companies BP and Chevron.

Entities showing the highest levels of support across at least two FMIA policies included aviation sector companies such as Air New Zealand and Qantas, which were particularly supportive of measures to increase low-carbon liquid fuels in air transport, alongside alternative energy industry associations, including the Clean Energy Council, Smart Energy Council, and Australian Hydrogen Council. Notably, Rio Tinto took supportive positions on the Review of the National Hydrogen Strategy and the consultation on Unlocking Green Metals Opportunities for a Future Made In Australia, as did Manufacturing Australia. Both entities come from sectors that have historically been less supportive of climate policy. The cross-sector industry association Ai Group was the most supportive of the cross-sector industry associations and ranked among the ten most supportive entities overall, supporting policies such as the Future Made in Australia Bill 2024 and the Hydrogen Headstart program. As a result, it was the most supportive of the cross-sector industry associations.

Unsupportive or oppositional positions came largely from the fossil fuel sector. The Australian Energy Producers, which represents Australia’s largest fossil fuel players, was the most oppositional entity to the FMIA plan and repeatedly called for the role of fossil fuels to be recognized in the policy. They are followed by several of its members including Inpex and Chevron which negatively engaged on the FMIA’s hydrogen-related policies and ExxonMobil, which did not appear to fully support the government’s proposals in the Low Carbon Liquid Fuel consultation paper.

Other unsupportive industry associations included the Australian Chamber of Commerce and Industry, the most unsupportive cross-sector industry association which advocated for support for hydrogen produced from fossil fuels, and the Chamber of Minerals and Energy of Western Australia (CME) which also appeared to advocate for government support for fossil fuels. Toyota was also unsupportive in its engagement on the FMIA overall, supporting the continued role of internal combustion engine vehicles over rapid electrification. This shows that while positive responses on the FMIA came from numerous sectors, unsupportive and oppositional positions largely came from the fossil fuel sector. An overview of the engagement on each policy area is provided below.

InfluenceMap assessed corporate engagement with 3 separate FMIA policies which aim to expand the development, production and use of hydrogen to decarbonize hard-to-abate sectors in the economy. Specifically, the Hydrogen Headstart program, Review of the National Hydrogen Strategy and the Hydrogen Production Tax Incentive.

While the Hydrogen Headstart program received broad corporate support, the National Hydrogen Strategy received mixed responses and negative positions from the fossil fuel sector on the Hydrogen Production Tax Incentive outweighed positive responses. While the Australian Hydrogen Council, Fortescue and Iberdrola expressed positive positions across the three policies, fossil fuel companies such as Woodside and Chevron were unsupportive, often advocating for the role of hydrogen produced from fossil fuels to be recognized, as did the cross-sector industry association Australian Chamber of Commerce & Industry.

For full details, please see the policy trackers pages for the Hydrogen Headstart program, Review of the National Hydrogen Strategy, and Hydrogen Production Tax Incentive.

InfluenceMap also assessed corporate engagement on both the Critical Minerals Production Tax Incentive and Unlocking Green Metals Opportunities for a Future Made In Australia. These policies aim to support critical minerals and low carbon metals production, with the latter feeding into the government’s Net-Zero Plan.

Multiple groups supported the implementation of the Critical Minerals Production Tax Incentive, although it was largely unclear whether respondents were supportive of an energy transition aligned with IPCC recommendations. Nevertheless, both the Smart Energy Council and Tesla communicated the need to deploy critical minerals to aid the transition to a renewables-dominated energy system. Regarding the consultation on supporting green metals, entities from multiple sectors, including Rio Tinto, Origin Energy and the Australian Hydrogen Council expressed broad support for the decarbonization of the metals and mining sector. Unsupportive positions were limited to BlueScope Steel, the Minerals Council of Australia and CME, all of which expressed support for the continued role of fossil fuels in the sector.

For full details, please see the policy trackers pages for the Critical Minerals Production Tax Incentive and Unlocking Green Metals Opportunities for a Future Made in Australia.

In the 2024-25 Budget, the Australian Government committed funding to develop a domestic Low-Carbon Liquid Fuels (LCLF) industry under the Future Made in Australia package, and a consultation was launched in June 2024. The consultation sought input on production incentives, and demand-side measures including mandates and eligibility requirements. Analysis of the consultation responses show that the government’s proposals received broad support, with the aviation sector (including Air New Zealand and Qantas) backing sustainable aviation fuel mandates, as did mining company Fortescue. The alternative energy sector was also supportive, with entities such as Iberdrola, the Clean Energy Council and Smart Energy Council supporting mandates and standards for LCLF. However, the fossil fuel sector appeared to take exception to elements outlined in the consultation paper, including Chevron, ExxonMobil and Origin Energy, advocating for a technology neutral approach and stressed the need to avoid ‘prescriptive’ or ‘rigid’ requirements. Toyota also stated that excessive regulation should be avoided while supporting incentives for LCLF, along with its industry association, the Federal Chamber of Automotive Industries (FCAI).

For full details, please see the policy trackers page for Unlocking Australia’s Low Carbon Liquid Fuel Opportunity.

The overall corporate engagement with the Senate Inquirys related to the FMIA was positive. The Future Made in Australia Bill 2024 received broad support from the resources and energy sectors, including Fortescue, the Smart Energy Council, the Clean Energy Council and Association of Mining and Exploration Companies (AMEC). Fortescue and the Smart Energy Council supported measures to prohibit funding from being used for fossil fuels, nuclear and carbon capture and storage projects. However, Chevron, Inpex and the Australian Energy Producers appeared to advocate for fossil gas to be eligible for government support as part of the bill.

The Future Made in Australia (Guarantee of Origin) Bill 2024 received even higher levels of support, with almost all sectors coming together to support the passing of the Bill, including AGL, Iberdrola, Fortescue, BP and Santos. Of the analyzed groups, only the Australian Aluminum Council and Australian Energy Council did not appear to fully support the bill.

For full details, please see the policy trackers pages for the Future Made in Australia Bill 2024 and Future Made in Australia (Guarantee of Origin) Bill 2024 Provisions and Related Bills.

In contrast to the corporate support found across the engagement with the Future Made In Australia plan, there appears to be limited industry support for nuclear power generation in Australia. The UN's Intergovernmental Panel on Climate Change (IPCC) details in its reports that while the role for nuclear energy can increase to support the uptake of renewable energy in 1.5°C aligned scenarios, its use must also be tied to a reduction in fossil fuel use. Analysis on the corporate engagement with the Inquiry into Nuclear Power Generation in Australia illustrates that the support shown for a nuclear-led approach in Australia often comes from entities that continue to support a role for fossil fuels in the energy mix which is misaligned with IPCC guidance. On the other hand, companies and associations that support a renewables-based energy mix are less supportive of nuclear energy in Australia.

On October 10th 2024, the Australian House of Representatives passed a resolution of appointment to establish the House Select Committee on Nuclear Energy, which launched the Inquiry into Nuclear Power Generation in Australia. The inquiry was open for submissions until November 15th 2024, with public hearings held between October 24th and December 17th 2024. Of the 12 respondents to the inquiry included in InfluenceMap’s database, 5 supported the consideration of nuclear power generation in Australia (Chamber of Minerals and Energy of Western Australia (CME), Minerals Council of Australia (MCA), Business Council of Australia (BCA), South Australian Chamber of Mines and Energy and Rolls-Royce).

According to LobbyMap's holistic assessment of these entities, three of the entities currently engage with a range of climate policies in a manner which is misaligned with science-aligned climate policy, while Rolls-Royce’s and BCA’s engagement is partially aligned. On the other hand, 3 entities were not in favor of, or opposed a nuclear roll-out (Clean Energy Council, Smart Energy Council and Tesla), all of which otherwise engage with a range of climate policy in a manner which is aligned with science-based policy. Four other entities expressed concerns about the plan’s economic and technical feasibility (Australian Aluminum Council, Australian Energy Council, Ai Group and Squadron Energy). Outside the inquiry itself, InfluenceMap’s broader findings on corporate engagement on nuclear energy in Australia reveal limited corporate support for its introduction in Australia. Since the Liberal/National Coalition announced its nuclear plan in June 2024, InfluenceMap has recorded 67 instances of corporate communication on the role of nuclear energy in Australia, with 25 (37.3%) supportive of an increased nuclear role, 36 (53.7%) opposed and 6 unclear (9%).

In addition to evaluating the level of support for a nuclear-led energy transition, InfluenceMap assessed the alignment of advocacy around the Inquiry into Nuclear Power Generation in Australia against IPCC guidance. This analysis found that corporate support for nuclear is often communicated alongside support for the continued role for fossil fuels in the energy mix, which is misaligned with the IPCC’s guidance on nuclear and the energy transition.

The UN's Intergovernmental Panel on Climate Change (IPCC) provides detailed guidance on the role of a range of different technologies that may (or may not) be needed for transitioning the economy in line with 1.5°C consistent pathways. For nuclear, the IPCC states that while its role is projected to increase by 2050 to ensure reliability and resource adequacy with higher levels of wind of solar, its use is tied to reductions in fossil fuels and increased electrification. At the same time, the IPCC explains that nuclear power continues to be affected by cost overruns, high upfront investment needs, challenges with final disposal of radioactive waste, and varying public acceptance and political support levels.

Full details of InfluenceMap’s benchmark for nuclear energy can be found here.

Analysis of the testimony and submissions to the Inquiry into Nuclear Power Generation in Australia reveals that companies that have science-aligned positions on the energy transition more broadly did not favor a nuclear-led approach in Australia. Tesla promoted the need to transition to a renewables-dominated energy system and both the Clean Energy Council and Smart Energy Council also stated the need to phase out unabated fossil fuels in the energy mix.

Positions found to be misaligned with IPCC guidance on the energy transition broadly came from entities that advocated a role for nuclear energy alongside fossil fuels. The South Australian Chamber of Mines and Energy, Chamber of Minerals and Energy of Western Australia and the Minerals Council of Australia all promoted the role of fossil fuels while supporting nuclear power generation in their testimony to the inquiry. In the Business Council of Australia’s submission, it advocated for a technology-neutral approach which included nuclear and renewables, although it was unclear whether the association supported the continued role of fossil gas. Rolls-Royce did not take a clear position on the transition of the energy mix beyond supporting a role for nuclear.

For full details, see the policy tracker page for the Inquiry into Nuclear Power Generation in Australia.