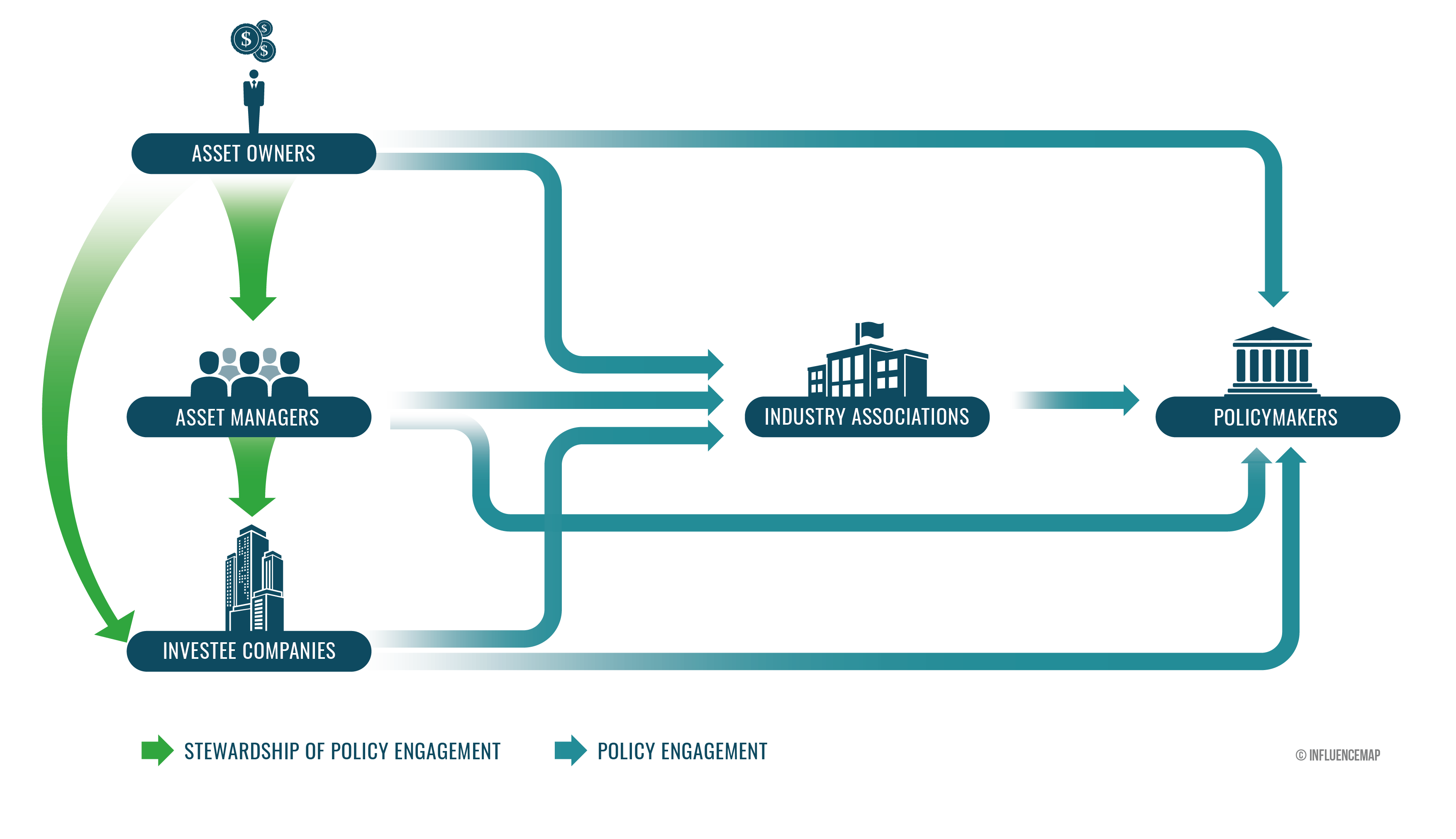

This research highlights a key opportunity for the world’s largest asset owners to increase their impact on addressing the climate crisis by facilitating the implementation of ambitious climate-related policy, both in the real economy and the financial sector. Asset owners may do this by conducting policy engagement directly and through industry associations, as well as by stewarding their asset managers and investee companies on these entities’ own climate lobbying activities. As long-term custodians of significant financial assets, asset owners have a vested interest in enabling the implementation of supportive policy frameworks to guide the transition, while holding substantial influence to do so. Although a core group of asset owners has emerged as leaders on direct climate policy engagement and stewardship of investee companies’ climate lobbying, this report finds that the bulk of the sector has significant room to improve in this key area of climate impact.

All firms covered in this research were offered the opportunity to review the analysis and provide feedback prior to release. For details on our content and terms of use, please see our Terms and Conditions.

For any questions about this report, please reach out to media@influencemap.org.