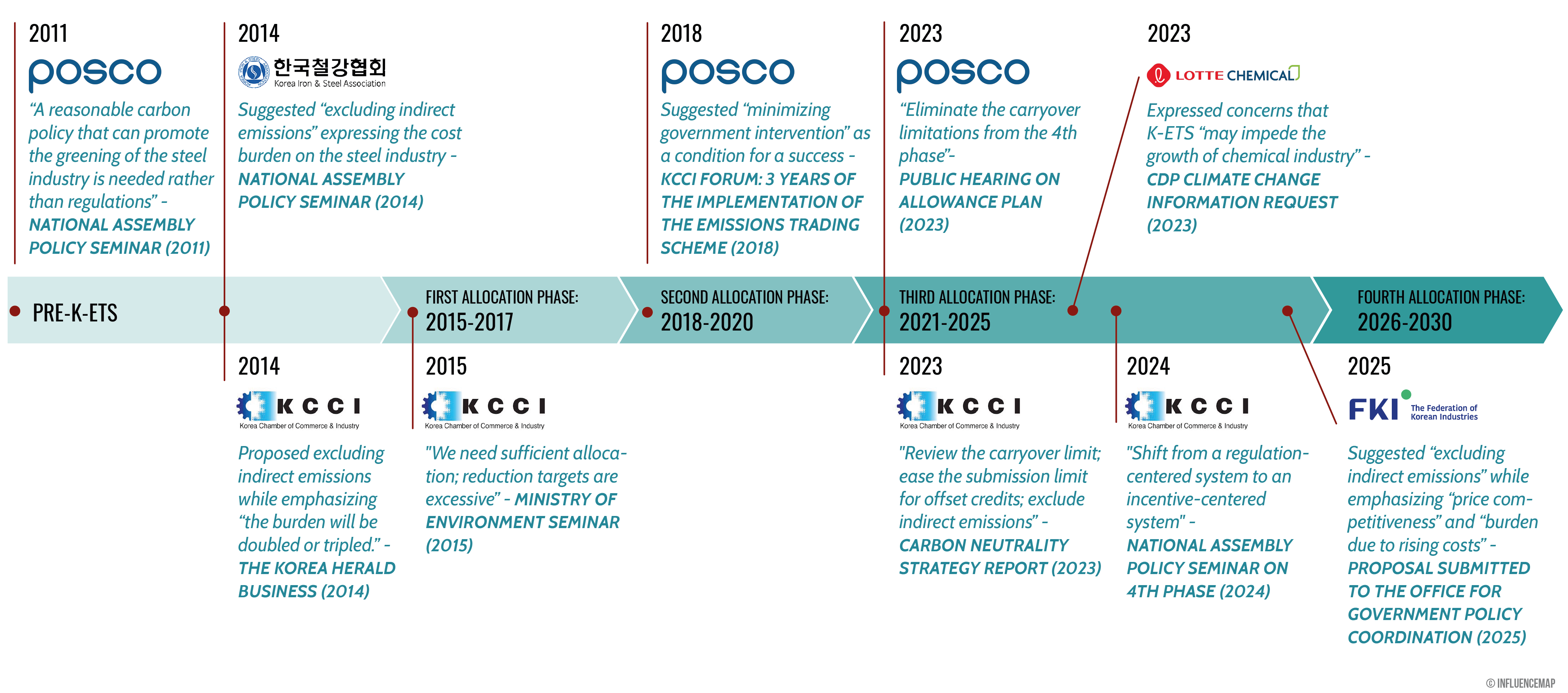

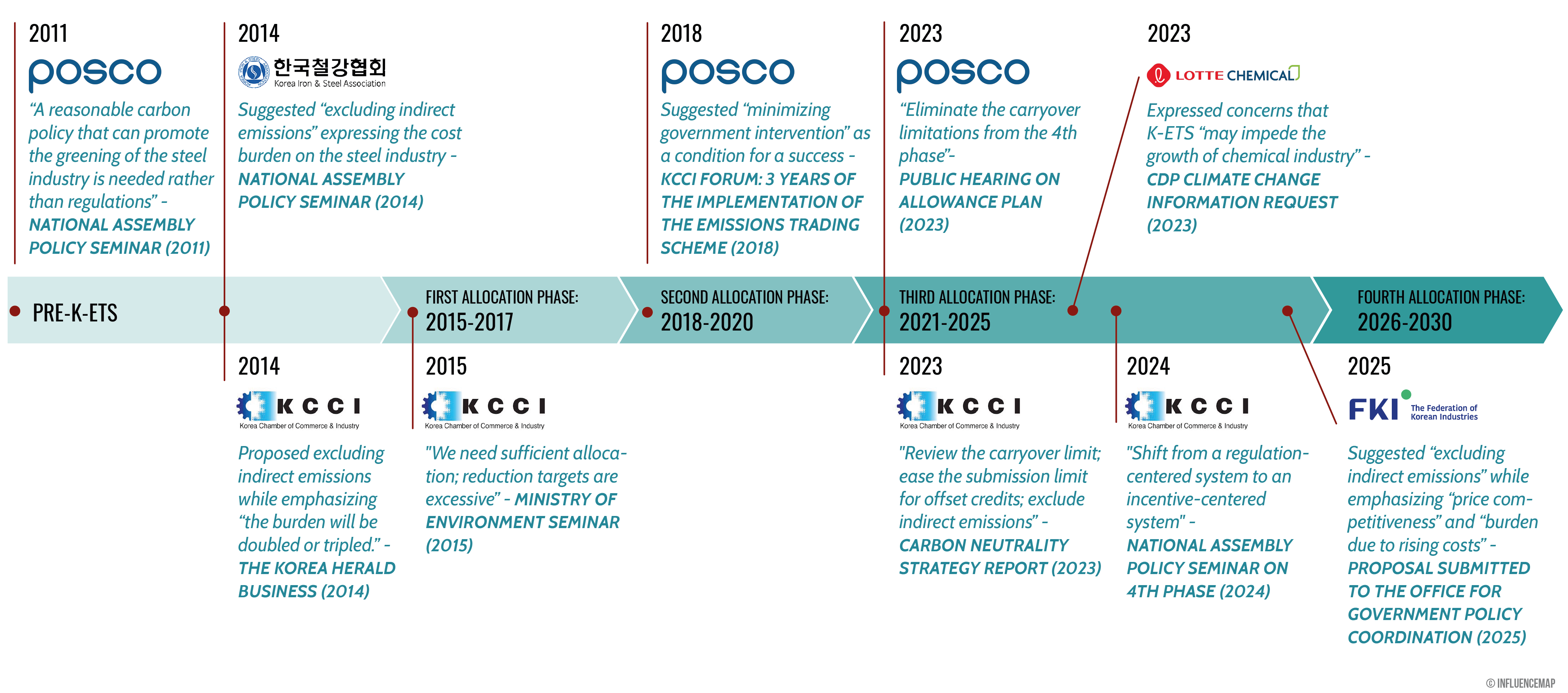

Chart 1. Corporate and industry influence on the K-ETS

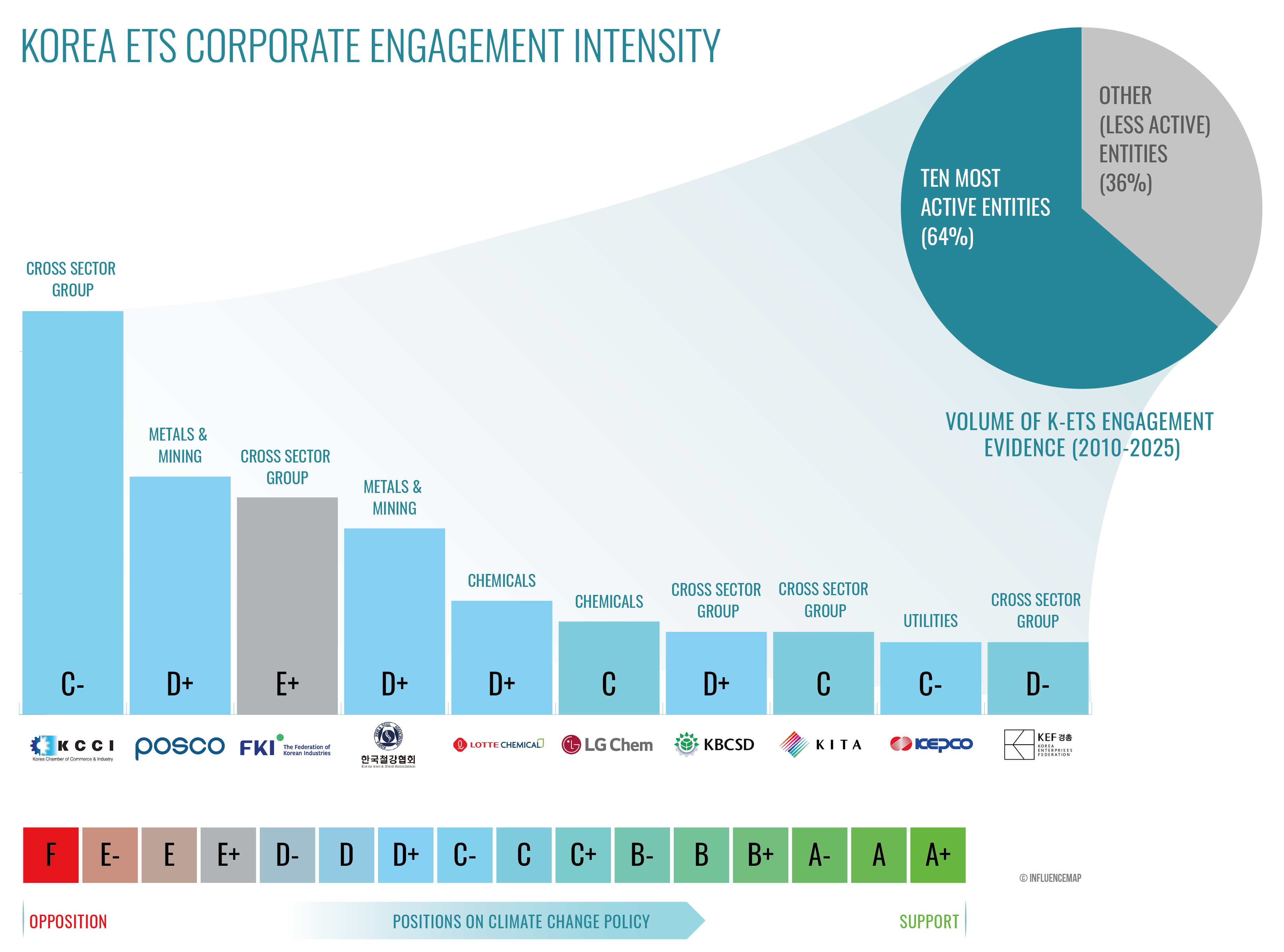

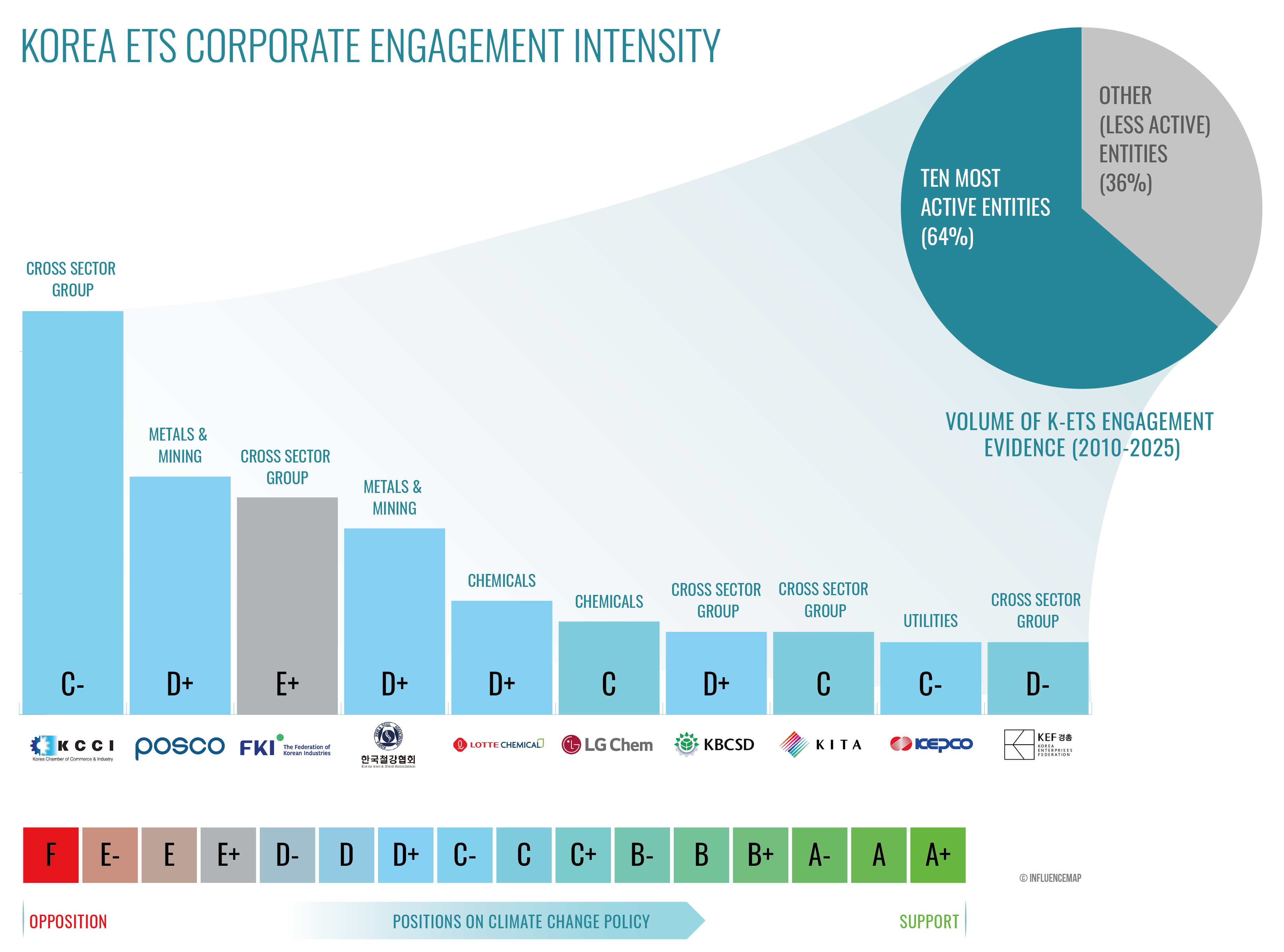

Chart 2. List of ten most actively engaged entities with the K-ETS

Background: Korea Emissions Trading Scheme (K-ETS)

Launched in January 2015, South Korea’s Emissions Trading Scheme (K-ETS) aimed to reduce greenhouse gas (GHG) emissions cost-effectively, incentivize corporate technology development, and serve as a model of good practice internationally. It is currently in the Third Allocation Phase (2021-2025). The K-ETS is recognized as one of South Korea’s key instruments for achieving its national GHG reduction target of a 40% cut by 2030, compared to 2018 levels. However, the effectiveness of the scheme depends heavily on the strength of its design and implementation. The Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (AR6) suggested that “Emissions reductions could be increased with higher carbon prices and without free allocation of allowances”1. The IPCC2 also emphasized that carbon prices must reach at least USD 40–80 per tonne of CO₂ by 2020 and USD 50–100 by 2030, USD 733 by 2050 to be consistent with the Paris Agreement targets, provided a supportive policy environment is in place.

In December 2024, the South Korean government finalized the Fourth Basic Plan for the K-ETS. According to the Act on the Allocation and Trading of Greenhouse Gas Emission Permits, a plan to allocate total national GHG emission allowances for the Fourth Allocation Phase will be established in the first half of 2025. This allocation plan will cover: (1) the total volume of greenhouse gas emission allowances in line with national reduction targets; (2) annual allocation volumes for the Fourth Allocation Phase; (3) sector-specific allocation standards; (4) allowance amounts per sector; (5) the reserve volume and distribution criteria; (6) rules on carryover and borrowing; and (7) offset guidelines. As such, the coming months represent a critical window for stakeholder engagement ahead of the Fourth Allocation Phase (2026–2030).

- Over the 10 years of the K-ETS implementation, both the total number of emission allowances and the average annual pre-allocation have increased with each phase. The total cap was 1,686,549,412 Korea Allowance Units (KAU)3 in the First Allocation Phase (2015-2017), 1,796,133,000 KAU in the Second Allocation Phase (2018-2020), and 5,082,258,880 KAU in the Third Allocation Phase (2021-2025). The average annual pre-allocation rose from 532,575,916 KAU in the First Allocation Phase to 547,660,222 KAU in the Second, and 580,419,273 KAU per year in the Third. This increase appears to have been influenced by cross-sector and steel sector engagement with the K-ETS policy.

- In the First Allocation Phase, Benchmarking (BM)4 allocation method was used for three sectors: cement, oil refining and aviation, while Grandfathering (GF)5 allocation method was used for the remaining sectors. The BM method has been expanded to seven sectors (power generation, integrated energy, industrial complexes and waste were added) in the Second Allocation Phase, and twelve sectors (steel, petrochemicals, building, paper manufacturing and timber industry were added) in the Third Allocation Phase.

- Regarding emission allowances, 100% of allowances were allocated for free across all sectors during the First Allocation Phase. In the Second Allocation Phase, 3% of allowances allocated to corporations were paid allowances, and the figure increased to 10% in the Third Allocation Phase. However, sectors meeting certain criteria – specifically, a trade intensity or production cost occurrence rate over 30% in the Second Allocation Phase, or a combined trade intensity x production cost occurrence rate over 0.2% in the Third Allocation Phase – continued to receive 100% free allowances. These sectors include oil refining, cement, basic chemical manufacturing, steel manufacturing, and electronic parts manufacturing.

A detailed summary of the historical K-ETS development can be found on our Korea Platform here.

Corporate and Industry Influencing on the K-ETS

- InfluenceMap analyzed the policy influence evidence on the K-ETS from 25 companies and 11 industry associations in South Korea (234 data points), which are available on InfluenceMap’s Korea platform. The analysis covers a 15-year timeframe (2010-2025) of corporate and industry influence, which covers the pre-implementation period of the K-ETS (2010-2014) and the post-implementation period (2015-2025). InfluenceMap’s data on corporate and industry engagement with the K-ETS has been collected from a range of publicly accessible sources, including government sources (e.g., official government websites and the national assembly’s policy data website), regulatory consultation comments, organizational websites, senior management statements, and reports from reliable media outlets. (A detailed description of InfluenceMap’s scoring methodology can be found in Appendix A or on our website here.) Around 25% of data points on corporate and industry engagement with the K-ETS is from government sources.

- Between 2010 and 2025, cross-sector associations accounted for the largest share of K-ETS engagement, representing 36% of the 234 data points, followed by the steel sector (20%), the chemical sector (11%) and the energy (oil & gas) sector (8%). These four sector categories alone accounted for over 75% of total engagement with the K-ETS. In contrast, sectors such as automakers, IT, and telecommunications have shown only marginal engagement. Notably, the sectors with the highest levels of engagement tended to influence the K-ETS more negatively.

- The Korea Chamber of Commerce and Industry (KCCI) has been the most active in engaging with the K-ETS, accounting for 17% of data points, followed by POSCO (10%), the Federation of Korean Industry (FKI) (9%), the Korea Iron and Steel Association (KOSA) (8%), and Lotte Chemical (5%). These five active entities comprise almost 50% of corporate and industry engagement with the K-ETS. Their advocacy has been largely negative, including advocacy for an increased number of free emission allowances, the exclusion of indirect emissions, easing of carryover limits6, and greater reliance on offsets7. These entities have consistently framed the K-ETS as a burden on industry and stressed the need to consider corporate competitiveness in trade-exposed sectors when implementing the policy. These positions run counter to the goal of reinforcing the carbon price signal and may undermine the effectiveness of the scheme.

The following are the recent narratives from the most actively engaged entities:

- KCCI: At a September 2024 National Assembly Policy Seminar on the 4th plan period of the K-ETS, KCCI’s Sustainable Management Institute did not support the K-ETS in its current form and advocated for an incentive-based system rather than a regulation-focused approach. In its May 2023 Carbon Neutrality Strategy Report, KCCI called for “reviewing the carryover limitation”, “easing the submission limit for offset credits” and “excluding indirect emissions” — positions that run counter to efforts aimed at tightening the system, eliminating surplus allowances, and strengthening the carbon price signal to improve the effectiveness of the K-ETS.

- POSCO: In an August 2024 article by Steel & Metal News, POSCO appeared to weaken the K-ETS by suggesting that surplus emission allowances should be saved to be re-entered into the system during a roundtable discussion with the Ministry of Trade, Industry and Energy. At a Public Hearing on the Amendment to the Third Allowance Plan hosted by the Ministry of Environment in September 2023, POSCO called for the “elimination of carryover limitations” in the Fourth Allocation Phase.

- FKI: In its ‘2025 Comprehensive Regulatory Improvement Tasks’ proposal submitted to the Office for Government Policy Coordination in April 2025, FKI called for the exclusion of indirect emissions from the K-ETS, while emphasizing “price competitiveness” and the “burden due to rising costs”. In its April 2025 press release, FKI did not support increasing the share of paid allocations for the power sector, warning of increased electricity prices and a loss of industrial competitiveness. Instead, it advocated for using K-ETS funds to help industries respond to increased electricity prices.

Corporate and industry narratives on the K-ETS by industry can be found on our Korea Platform (in the ‘Policy Engagement Overview’ tab).

Appendix A. InfluenceMap’s Methodology

InfluenceMap has developed a globally recognized methodology for assessing corporate influence on climate policy, widely used by investors around the world. We are a key partner in the Climate Action 100+ initiative — the world’s largest investor engagement program on climate change, which includes over 600 investors. Our data informs the global investment community, enabling shareholders to evaluate climate-related risks within companies and promote strong climate governance across the corporate sector.

Our methodology is based on several core principles:

- Objectivity and Transparency: InfluenceMap adheres to widely accepted standards for corporate assessment metrics, ensuring objectivity, clarity, ease of use, and the ability to make meaningful comparisons both across and within sectors.

- Definition of Policy Engagement: We define “policy engagement” according to the United Nations’ 2013 Guide for Responsible Corporate Engagement in Climate Policy. This guide outlines a range of corporate activities that constitute policy engagement, including advertising, social media, public relations, sponsored research, direct interaction with regulators and elected officials, and participation in advisory committees.

- Focus of Assessment: InfluenceMap does not evaluate the climate policies themselves. Instead, we assess corporate engagement with climate policy using independent, transparent benchmarks. These benchmarks are based on government climate policy goals and the policy guidance of the Intergovernmental Panel on Climate Change (IPCC).

- Data Sources: Our analysis relies on a diverse range of publicly accessible and verifiable data sources that accurately reflect corporate policy engagement. While we recognize that certain aspects of corporate influence—such as private meetings or undisclosed discussions—are not publicly documented, our methodology draws from a substantial body of publicly available data. We believe this provides a robust and representative picture of corporate positions on climate policy.

Full details of InfluenceMap’s global methodology are available on our website. The Korean methodology has been adapted from this global framework; with details specific to the Korea platform can be found here.

Footnotes