The fossil fuel sector is maintaining a pattern of entrenched opposition to Australia’s energy transition even as broader corporate support for action grows. Analysis of corporate climate policy engagement trends across the key climate policies covered by InfluenceMap’s Australia Policy Tracker points to a growing divergence between the pro-fossil fuel advocacy of companies and industry associations representing the fossil fuel sector and the pro-renewable positions of companies from across the wider economy.

An opportunity window remains for companies and industry associations to advocate for a science-aligned 2035 emissions target in Australia’s updated Nationally Determined Contribution (NDC). InfluenceMap analysis of corporate engagement with Australia’s NDC reveals evidence of a discrepancy between the supportive positions of companies such as Fortescue, BHP, AGL, and Origin and oppositional positions of key industry associations, including the Minerals Council of Australia, Australian Energy Producers, and Chamber of Minerals and Energy of Western Australia.

The Environment Protection and Biodiversity Conservation Act (EPBC) is set to remain a key focus of corporate advocacy in the back-half of 2025 following the Labor government’s recognition that its reform is a “very high and immediate” priority. Previous InfluenceMap analysis of corporate engagement with Australia’s EPBC reforms suggested evidence of a concerted effort from the mining and business sectors, spearheaded by the Business Council of Australia and Minerals Council of Australia, to weaken the climate ambition of the reforms.

Australia’s 2025 federal election delivered a decisive climate mandate to the Australian Labor Party, with Labor’s largely renewable-led energy agenda seeing it achieve a landslide victory over the Liberal-National Coalition—which campaigned on a platform of nuclear energy and a slower renewables transition. The ambition and pace of Labor’s climate agenda will be influenced by corporate climate policy engagement trends, with important implications for both businesses pursuing decarbonization pathways and investors managing climate risk.

This briefing draws on InfluenceMap’s LobbyMap database, Australian Policy Tracker tool, and April 2025 briefing on corporate engagement with Australia’s Future Made in Australia Plan to offer three key observations on Australian corporate advocacy that are likely to inform climate policy developments in the first year of Labor’s second term in government.

The tension between Labor’s commitment to transition Australia into a “renewable energy superpower” and Australia’s position as the world’s third-largest fossil fuel exporter is set to be an enduring trend in Labor’s second term. This trend is reflected in the lobbying patterns of corporate Australia, with previous InfluenceMap research revealing evidence of a growing divergence between the pro-fossil fuel advocacy of companies and industry associations representing the fossil fuel sector and the pro-renewable positions of companies from across the wider economy.

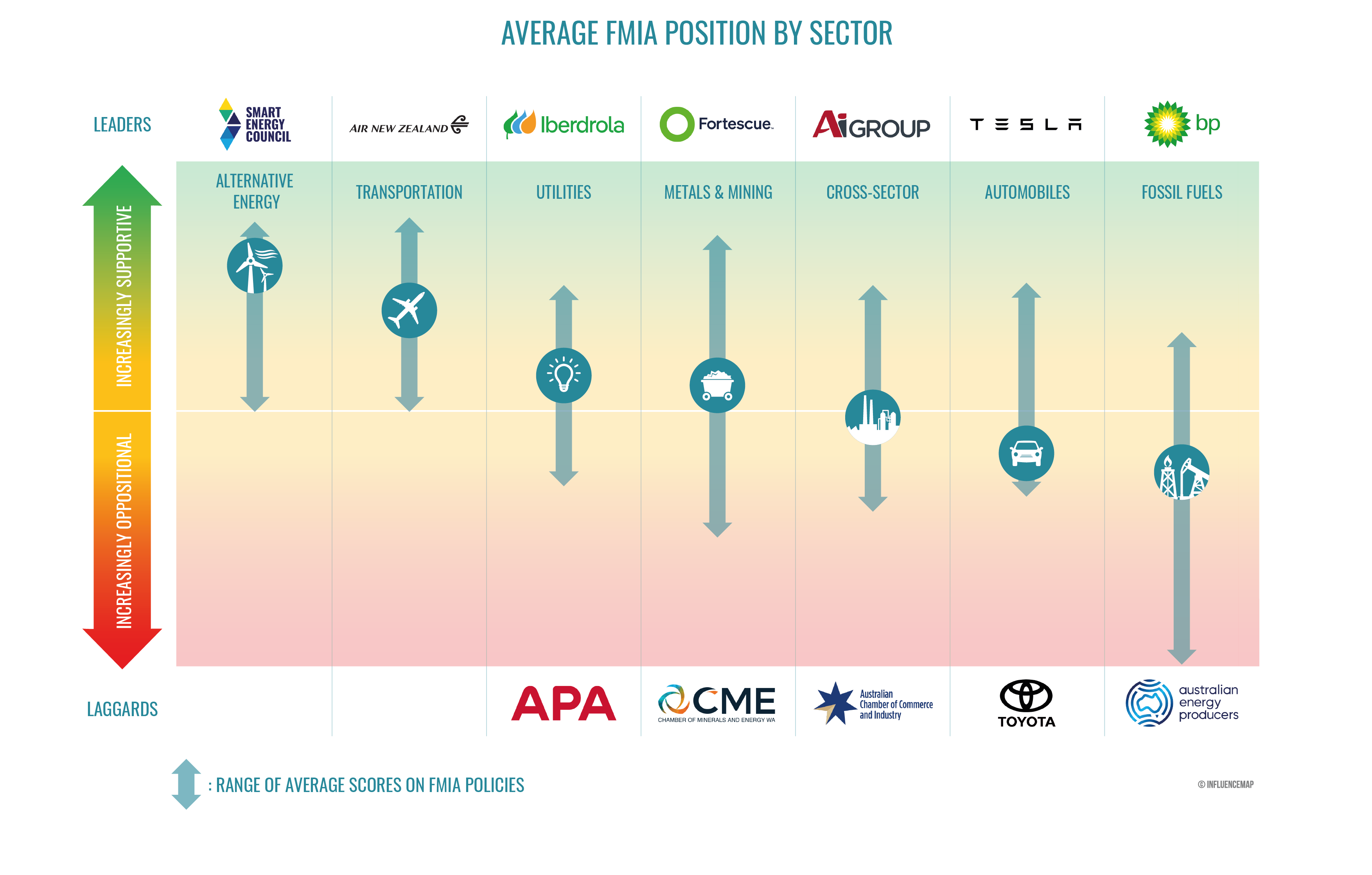

InfluenceMap’s April 2025 analysis of corporate consultation responses to eight of the key initiatives under the Future Made in Australia plan (FMIA) found that support for the clean energy measures under the plan was strong from industries central to Australia’s economy, including the metals and mining, utilities, and transport sectors. The research identified Fortescue and Tesla as the most positively engaged companies across the eight initiatives, with industry associations representing the alternative energy sector, such as the Australian Hydrogen Council, Clean Energy Council, and Smart Energy Council also supporting the FMIA’s focus of facilitating an accelerated clean energy transition. A broad coalition of corporate actors have reiterated their support for an accelerated transition to renewables following the election result, with the Energy Efficiency Council and Carbon Market Institute calling for increased government ambition on electrification and emissions objectives. Fortescue likewise publicly opposed Labor’s recent decision to extend Woodside’s North West Shelf fossil gas project until 2070, emphasizing the need to rapidly transition away from fossil fuels.

In contrast, Australia’s fossil fuel sector appears to be maintaining a pattern of entrenched opposition to climate policy, even as broader corporate support for action grows. A common theme across the climate policies covered in InfluenceMap’s Australia Policy Tracker is that of fossil fuel companies advocating to weaken the climate ambition of initiatives designed to spur investment in renewable energy. For example, the Australian Energy Producers, which represents Australia’s largest fossil fuel players, repeatedly called for the FMIA plan to be expanded to include support for fossil gas, while Woodside and Chevron advocated for the role of hydrogen produced from fossil fuels to be recognized in the plan. Average corporate sector positions across the FMIA plan are displayed in the graphic below.

Sector icons indicate the average FMIA position for each sector, while arrows show the range between the most positive and most negative entities on average within that sector. Leaders are the most positive entities across FMIA-related policies in their sector, while Laggards are the most negative. To be identified as a Leader or Laggard, an entity must have engaged with at least two FMIA-related policies covered in this briefing.

Groups such as EnergyAustralia, Origin Energy, APA Group, the Australian Pipelines and Gas Association, and the Energy Users Association of Australia have also previously advocated for Australia’s Capacity Investment Scheme to be expanded to include support for fossil gas. The scheme currently explicitly excludes fossil fuel-based energy. Such advocacy risks isolating these companies from the growing coalition of corporate actors promoting a rapid increase in Australia’s renewable capacity.

Australia’s energy transition and the future role of fossil gas are set to remain key focus areas of corporate advocacy in Labor’s second term with both clean and fossil fuel entities advocating to advance their aims at the federal and state levels. These competing pathways will place increasing pressure on the Labor government to resolve the inherent conflict between its stated renewable and decarbonization objectives and its ongoing support for new fossil fuel projects.

Upcoming opportunities for corporate engagement include the Australian Energy Market Operator’s 2025 Gas Infrastructure Options Report Consultation and 2025 Electricity Network Options Report Consultation, which will inform Australia’s 2026 Integrated System Plan—the nation’s roadmap for guiding energy infrastructure and investment.

InfluenceMap's research of corporate climate policy engagement during the Labor Government's first term also finds evidence of much higher engagement from vested fossil fuel interests compared to other sectors. In contrast, companies with more positive positions largely display less active engagement. This trend is mapped in Table 1 and Table 2 in the Apendix, which show the top 25 companies and top 25 industry associations most engaged with climate change policy in Australia during Labor's first term.

Notably, 17 of the 25 most engaged companies (68%) represent the mining, energy and utilities sectors and are involved in either the large scale production, procurement, or distribution of fossil fuels. In addition, none of the 25 most engaged companies demonstrate science-aligned climate policy engagement, with 80% displaying partially science-aligned climate policy engagement and 20% demonstrating misaligned engagement.

The interests of the fossil fuel sector are also represented by Australia's most engaged industry associations on climate. 11 of the 25 most engaged associations (44%) on climate during Labor's first term directly represent the fossil fuel sector. As for companies, industry associations taking more oppositional positions displayed higher levels of engagement, with only 5 of the 25 most engaged associations (20%) demonstrating science-aligned climate policy engagement. In contrast, 12 (48%) display partially science-aligned climate policy engagement, while 8 (32%) demonstrate misaligned engagement.

All signatories to the global Paris Agreement are required to set 2035 Nationally Determined Contributions (NDCs) by September 2025. Labor is currently waiting on further guidance from the Climate Change Authority (CCA) before finalizing its 2035 greenhouse gas emissions target as part of its updated NDC, with the CCA’s initial advice in April 2024 suggesting a 2035 target of between 65% and 75% on 2005 levels would be “ambitious” yet “achievable."

Previous InfluenceMap analysis of corporate engagement with the CCA’s April 2024 Issues paper: Targets, Pathways and Progress revealed evidence of a discrepancy between the positions of companies representing the mining and energy sectors and several of their industry associations. Companies including Fortescue, BHP, AGL Energy, and Origin Energy, appeared to express broad support for ambitious 2035 emissions targets, with Fortescue advocating for emissions reductions of at least 75% to be achieved without carbon offsets and Origin stating that it was “pleased to see” the CCA propose relatively ambitious 2035 targets.

These positive positions stand in contrast to the wider engagement trends of industry associations representing the mining and energy sectors, including the Minerals Council of Australia (BHP holds board-level membership), Australian Energy Producers (Origin’s CEO sits on board), Chamber of Minerals and Energy of Western Australia (BHP holds board-level membership, Fortescue general membership), and Energy Networks Australia.

These associations appeared to support the CCA’s proposal with various exceptions that risk undermining the ambition of Australia’s 2035 targets. Common exceptions include: calls for Australia’s 2035 targets to be aligned with the availability of technological development; and arguments that overly ambitious 2035 targets could result in unrealistic emissions reduction requirements for facilities under the Safeguard Mechanism and also undermine the country’s international competitiveness.

InfluenceMap’s analysis also points to a lack of active engagement on Australia’s 2035 Nationally Determined Contribution from other sectors of the Australian economy. InfluenceMap’s LobbyMap database covers 71 companies and 30 industry associations headquartered in Australia or with significant operations based in the country. Of this group, only 28 companies and associations (28%) engaged with the CCA’s April 2024 issues paper. Notably, there is a gap in engagement from the financial sector, with only National Australia Bank demonstrating transparent engagement with the consultation.

Australia’s 2035 emissions target will underpin the ambition of the country’s wider climate policy architecture. There remains an opportunity window for companies and industry associations to advocate for a science-aligned 2035 target in Australia’s updated NDC and for companies to act on any misalignments between their advocacy positions and those of their industry associations. It is likely that such advocacy would be needed to bolster other positive voices such as Tesla, the Clean Energy Council, and Carbon Market Institute in counterbalancing the oppositional positions of groups representing the fossil fuel sector, including Woodside, APA Group, the Australian Pipelines and Gas Association, and the Australian Energy Producers.

Following its failure to successfully legislate reforms to Australia’s national environmental law—the Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act)—in its last term, the Labor government has again identified reform of the EPBC Act as a “very high and immediate” priority. In November 2024, negotiations on the second stage of Labor’s planned EPBC reforms collapsed after Prime Minister Anthony Albanese intervened to rule out a deal with the Greens Party and Independent Senators David Pocock and Lidia Thorpe that would integrate climate considerations into the environmental assessment process. Australia’s EPBC Act does not currently require decision-makers to consider greenhouse gas emissions when assessing projects.

Previous InfluenceMap analysis of corporate engagement with the EPBC reforms appears to indicate evidence of a concerted effort from the mining and business sectors to weaken the climate ambition of the reforms. Key positions included opposition to the introduction of climate considerations into the EPBC Act and opposition to the government’s proposal to delegate decision-making powers for environmental project approvals to an independent Environment Protection Authority.

This oppositional campaign appeared to be spearheaded by the Business Council of Australia and Minerals Council of Australia, with both associations advocating against the inclusion of a climate trigger or other climate considerations in Australia’s EPBC Act in submissions to a July 2024 Senate Inquiry and in 2024 press releases and media articles. Arguments cited included concerns around project approval delays and economic impacts and suggestions that regulation of greenhouse gas emissions is already dealt with under existing climate legislation.

There are indications that this coordinated advocacy campaign was successful in drawing notable concessions from the Labor Government. In a 16 September press conference, Prime Minister Anthony Albanese appeared to recycle several of the key narratives employed by industry to water down the potential climate ambition of the policy, including stating that "I don’t support adding a trigger to that legislation … Climate issues are dealt with through the safeguard mechanism.” Prime Minister Albanese was also previously reported to have offered to water down the decision-making powers of the proposed Environmental Protection Authority in a bid to secure Coalition support for the Nature Positive Bills, a concession the Minerals Council of Australia appeared to suggest was the result of "considerable pressure" from industry groups.

Progress on Labor’s proposed EPBC reforms will be a focus throughout the second half of 2025, with growing industry calls for the government to prioritize its environmental reforms, including a May 2025 joint letter calling for the legislation to include the introduction of National Environmental Standards and the establishment of an independent Environment Protection Authority. These voices join other industry associations who have previously supported the introduction of climate change considerations into the EPBC Act, such as the Carbon Market Institute, Clean Energy Council, and Smart Energy Council.

InfluenceMap will continue to track developments on the EPBC reforms on its Australia policy tracker page.

| Company | Sector | Instances of Climate Policy Engagement in Australia During Labor's First Term | InfluenceMap Performance Band |

|---|---|---|---|

| AGL | Utilities | 151 | C+ |

| Origin Energy | Utilities | 115 | C |

| Woodside | Energy | 115 | D- |

| Fortsecue | Metals & Mining | 114 | B- |

| Jemena | Energy | 97 | D+ |

| Bluescope | Metals & Mining | 85 | C- |

| Squadron Energy | Energy | 83 | B- |

| APA Group | Utilities | 81 | D+ |

| BP | Energy | 78 | C- |

| Santos | Energy | 72 | D |

| Qantas | Transportation | 64 | C |

| BHP | Metals & Mining | 63 | C- |

| NAB | Financials | 61 | C+ |

| Rio Tinto | Metals & Mining | 57 | C- |

| Commonwealth Bank of Australia | Financials | 55 | C+ |

| Alinta Energy | Energy | 43 | D- |

| Whitehaven Coal | Metals & Mining | 43 | E |

| Orica | Industrials | 38 | C |

| Virgin Australia | Transportation | 38 | C |

| EnergyAustralia | Utilities | 37 | C |

| Hancock Prospecting | Metals & Mining | 35 | E- |

| Shell | Energy | 35 | C- |

| Toyota Motor | Automobiles | 34 | D+ |

| Westpac | Financials | 34 | C+ |

| Glencore | Metals & Mining | 32 | D+ |