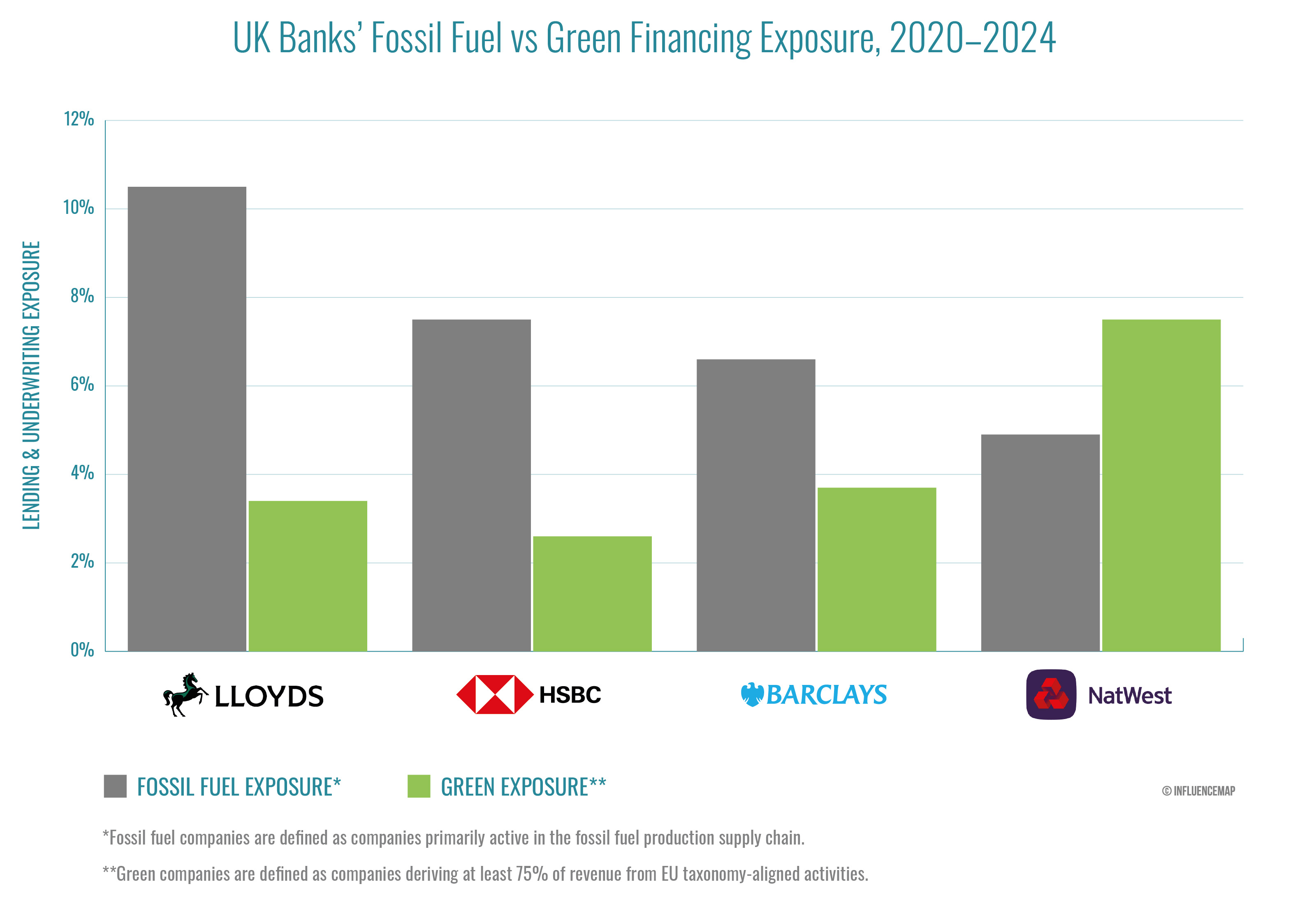

A new InfluenceMap report assessing the UK’s four largest banks (Barclays, HSBC, Lloyds, and NatWest) shows that despite their climate commitments, all four banks continue to finance (1) high emitters across the oil and gas, power, and automotive industries at a rate that is incompatible with the International Energy Agency’s Net Zero Emissions by 2050 Scenario. Three of the four banks (Barclays, HSBC, and Lloyds) financed more to fossil fuel companies than ‘green’ (2) companies every year for the last three years. NatWest was the only bank of the four to favor financing to green companies.

Despite all four banks setting net zero by 2050 targets and restrictions on direct financing to fossil fuel expansion, the banks’ exclusion policies still leave room for the continued flow of capital to companies expanding oil and gas exploration. The banks state that their financing is based on companies having a transition plan or decarbonization strategies, but none prohibit financing to companies that continue to expand oil and gas production. This is despite the IEA NZE Scenario not requiring new oil and gas field development beyond those approved in 2021 to reach net zero by 2050.

At the same time, this research finds that in direct engagement with the UK government, both Barclays and HSBC lobbied against the ambition of the UK’s proposed sustainable finance framework, risking the credibility of the transition plan assessments that underpin their exclusion policies. Some of the banks' advocacy appears to have been reflected in a reduction in government policy ambition, for example in the failure to recommit to the implementation of a UK Green Taxonomy and lack of clarity surrounding mandatory transition plan disclosure.

Without clear policy outlining eligibility criteria for transition finance, there is significant risk of greenwashing by the banks through continued financing to high-emitting activities, particularly as the UK government, under current Chancellor Rachel Reeves, has made transition finance a central pillar of its plan to make the UK an attractive environment for investment. This is supported by the findings of the Intergovernmental Panel on Climate Change (IPCC), which noted the limited evidence around the decarbonization benefit of financing high-GHG emissions activities due to the difficulty of assessing the alignment of transition financing with climate mitigation goals and the risk of “locking in” a higher rate of future emissions.

InfluenceMap’s research finds that in their engagement with government policy, only NatWest and Lloyds recognized the risks of greenwashing and carbon lock-in associated with increased financing to high-emitting sectors. NatWest was the sole bank to continuously advocate to the UK government in favor of mandatory transition plan disclosures. In contrast, Barclays actively advocated against regulatory requirements to determine eligibility for transition finance, while HSBC cautioned the government against defining what a “credible net-zero transition” looks like.

Between 2020 and 2024, three of the four UK banks consistently favored financing to fossil fuel companies over green companies: Lloyds at a ratio of 3.1 to 1, HSBC 2.9 to 1, and Barclays 1.8 to 1. NatWest is the only one of the four to oppose this trend: in each year from 2020 to 2024, its total financing deal value to green companies was greater than to fossil fuel companies, at an average ratio of 1.5 to 1.

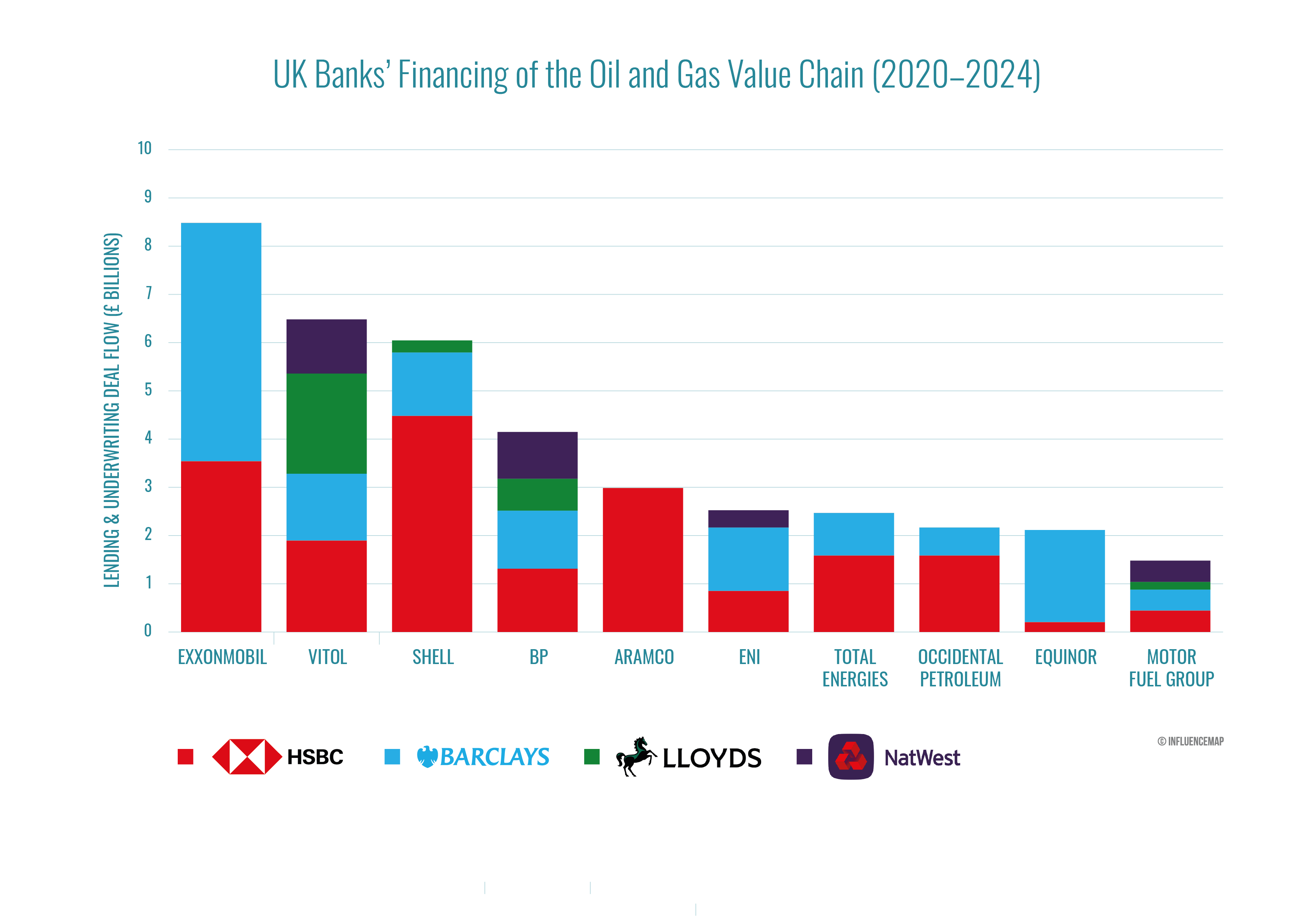

The report identifies £119 billion in financing from the UK banks to the fossil fuel sector between 2020 and 2024, spread over 1,183 individual deals with 354 companies. Five oil majors—ExxonMobil, Shell, BP, Aramco, and TotalEnergies—cumulatively received £24.1 billion in financing deal flows from the UK banks, accounting for 20.3% of the banks’ total identified fossil fuel financing. Companies identified as green receive considerably less financing from the Big Four UK Banks. Combined, the banks facilitated £59.7 billion in financing to green companies from 2020 to 2024, representing 3.5% of total financing assessed. This is half (50.3%) of the deal flow value that went to the fossil fuel sector.

More broadly, analysis of the four banks’ 2020–2024 lending and underwriting deals to companies in the automotive, power, and upstream oil and gas sectors finds their forecasted activities to be misaligned on average with the IEA NZE’s scale-up of green technologies and phaseout of polluting ones.

Bonnie Steinberg, Senior Analyst at InfluenceMap said

The Big Four UK Banks highlight the financial risks posed by climate change in their reporting and disclosures, but they aren’t taking strong action to address them. The banks' continued financing of expansionary oil and gas companies, and Barclays’ and HSBC’s pushback against sound climate-related financial policy, only worsen the long-term risks these banks face. To match the ambition of their top-line targets, the banks’ exclusion policies should recognize fossil fuel expansion as a stranded asset while focusing their transition efforts away from carbon lock-in and towards science-based definitions of green technologies

Jeanne Martin, Head of the Banking Programme at ShareAction said

As this report uncovers, there is a worrying gap growing between what the UK’s biggest banks are publicly saying about climate and what they are lobbying for behind closed doors. If these banks are to stand any chance of meeting their own net zero commitments they should be working to support sustainability regulations that will prevent the worst effect of global heating, not trying to water them down. We are already seeing a rise in extreme weather events caused by climate change in Britain, impacting communities and increasing risks for our economy. Investors must engage with banks on this critical issue, and take action if it is clear banks are working to counter regulations that we urgently need to better protect people and the planet.

Julie Baddeley, Chair at Chapter Zero said

Our banking sector has a vital role to play in pushing towards a net zero UK economy, in its approach to both investment and lending. Strong disclosure and governance will be essential if we are to maximise finance for the green transition, which is so important to addressing climate change.

Kitty Hatchley, Media Manager, InfluenceMap (London)

Email: kitty.hatchley {@} influencemap.org

(1) ‘Financing’ is defined as corporate lending and bond and equity underwriting activities.

(2) 'Green' companies are defined on the basis of the EU taxonomy for sustainable activities (abbr. “EU taxonomy”). Specifically, all companies with over 75% of revenue deriving from activities which demonstrate substantial contribution to climate change mitigation under the EU taxonomy are considered “green” under this methodology.