Analysis of corporate engagement with the UN Global Plastics Treaty prior to and during the most recent round of negotiations in August 2025 reveals how narratives pushed by chemical and petrochemical advocates contributed to the collapse of the talks. Negotiations concluded on 15 August 2025 without an agreement. Reports suggest that the talks were divided between a group of around 100 nations supporting a treaty that provides limits on production and bans on dangerous products, and on the other side, some of the largest oil-producing nations including Saudi Arabia, Russia, and the U.S., advocating against measures to reduce production. These nations also appeared to make statements echoing familiar narratives pushed by the chemical and petrochemical sectors prior to, during and after the negotiations.

Overall corporate engagement with the UN Global Plastics Treaty reflected a mix of positive and negative positions. InfluenceMap identified 62 instances of corporate engagement between December 2024 and August 2025; 27 were positive, and 22 were negative. The majority of positive advocacy, approximately 67%, came from the consumer goods and retail sectors, including the Business Coalition for a Global Plastics Treaty and members such as Unilever, Danone, and Nestlé.

The analysis reveals strong opposition to an ambitious Treaty from companies and industry associations in the chemical and petrochemical sectors. 56% of negative advocacy originated from these sectors, followed by cross-sector industry associations, which often reflect the positions of their most negative members, at 26%. Industry associations active on the issue include the American Fuel & Petrochemical Manufacturers (AFPM) and the American Chemistry Council (ACC), both of which have opposed limits on plastic production. This finding is consistent with InfluenceMap’s November 2024 analysis that assessed engagement with the Plastics Treaty from 2022 to 2024. Reports during and after the negotiations also emphasized the significant influence of fossil fuel and chemical industry lobbyists, with at least 234 registered to participate.

Positive engagement was largely limited to the Business Coalition and its members. Of the 39 positive companies and industry associations identified by InfluenceMap, 36 are members of the Coalition. InfluenceMap found evidence of only eight of the 36 Coalition members engaging in direct positive advocacy (advocacy that was independent from the Coalition). At the same time, just five instances of positive engagement from the Coalition on the Treaty were found between INC 5.1 (December 2024) and INC 5.2 (August 2025).

21 Coalition members are also members of one or more industry associations that engaged negatively with the Treaty, highlighting the risk that the support companies are providing through the Coalition is being offset by their membership to more active associations that are opposing the Treaty.

The companies and industry associations opposing a more ambitious Plastics Treaty deployed strategies similar to those long used by the fossil fuel industry to resist the transition to cleaner energy. Their arguments minimized the need to limit plastic production, promoted voluntary or flexible policy approaches, and framed plastics as essential for economic and social outcomes. By focusing on incremental solutions, technological innovation, or waste management alone, actors such as AFPM and ACC are diverting attention from the most impactful measures under consideration at the Plastics Treaty negotiations.

The upcoming seventh session of the United Nations Environment Assembly (UNEA-7) in Nairobi in December 2025, could determine the next steps for the Plastics Treaty process following the breakdown of talks in Geneva. While the UNEA-7 session does not formally list the Plastics Treaty on the agenda as a dedicated item, the process around the Treaty and its mandate (via UNEA Resolution 5/14) means the meeting will likely be a key moment for progress updates, ministerial reflection and potential next-steps for the Treaty process. The findings of this analysis highlight the corporate influence that may continue to shape how UNEA member states choose to revive negotiations and define the path toward a global agreement on plastic pollution.

In March 2022, the fifth session of the UN Environment Assembly (UNEA) adopted a Resolution to end plastic pollution and establish an Intergovernmental Negotiating Committee (INC) to develop a global, legally binding instrument that addresses the full lifecycle of plastics. The Resolution highlighted the importance of implementing policy measures covering the whole lifecycle of plastics, and noted the urgent need to promote, incentivize, and regulate the sustainable production and consumption of plastics.

The INC released a “Zero Draft” framework in September 2023, outlining a vision for countries to pursue “prevention, progressive reduction and elimination of plastic pollution throughout the lifecycle of plastic.” The framework provided a starting point to facilitate and support negotiations, introducing options for an international and legally binding instrument on plastic pollution.

InfluenceMap’s November 2024 analysis, which assessed engagement by members of the plastics value chain with the UN Global Plastics Treaty in 2022–2024, identified strong support from the consumer goods and retail sectors for an ambitious, science-aligned Treaty, including upstream solutions, such as the elimination of problematic plastic materials and chemicals of concern, better product design, and scaling of reuse and refill systems. In contrast, chemical and petrochemical companies and industry associations opposed production cuts, favoring downstream measures like recycling and innovative technologies.

The INC aimed to conclude negotiations and finalize the text of the agreement by its fifth and final convention (INC-5.1), scheduled for 25 November to 1 December 2024 in Busan, Republic of Korea, but no agreement was reached at the convention. Negotiations resumed (INC-5.2) in Geneva, Switzerland, but again concluded on 15 August 2025 without an agreement. Reports suggest that the negotiations were divided between a group of around 100 nations supporting an ambitious and legally binding Treaty that provides limits on production and bans on dangerous products, and on the other side, some of the largest oil-producing nations including Saudi Arabia and Russia, as well as the U.S. advocating against measures to reduce production.

Negotiations are expected to continue with a third session scheduled for February 2026. However, this session is a one-day resumed session limited to organizational and administrative matters. According to UN Environment Programme (UNEP), no substantive negotiations will take place, and therefore, a date for subsequent negotiations has yet to be determined.

Analysis published by the Center for International Environmental Law (CIEL) at the commencement of the August 2025 INC-5.2 negotiations in Geneva found that at least 234 fossil fuel and chemical industry lobbyists registered to participate. This was an increase from the previous round of negotiations in November 2024 in Busan, where CIEL identified 221 lobbyists from these sectors registered to participate. CIEL’s August 2025 analysis states that the “strong presence of lobbyists at this stage of the negotiations raises concerns about corporate influence at a pivotal moment.”

This briefing covers InfluenceMap’s analysis of engagement by members of the plastics value chain with the UN Global Plastics Treaty since the conclusion of INC-5.1 in December 2024, up to and including INC-5.2 in August 2025. The research overviews the advocacy positions of the companies and industry associations in the LobbyMap database most engaged on the Treaty, providing an update on the trends identified in InfluenceMap’s November 2024 analysis, which detected intense, unsupportive engagement from the chemical and petrochemical sectors.

The current analysis on the run-up to and including INC-5.2 utilizes CIEL’s findings to assess engagement with the Treaty from companies and industry associations present in Geneva and includes an analysis of the common misleading narratives that entities promoted in their obstructive engagement with the UN Global Plastics Treaty.

Given the limited transparency surrounding the Plastics Treaty negotiations, it is not possible to systematically track how companies and industry associations engage within the INC process itself. Observer and stakeholder interventions and interactions are not consistently published, and closed-door consultations mean that much of the lobbying occurs out of view. As a result, this analysis draws solely on information that is publicly accessible, such as press releases, organizational statements, media reporting, website content, and joint letters, to assess how companies and industry associations have sought to influence the negotiations. These sources provide the clearest available record of corporate and industry advocacy in an otherwise opaque negotiation environment.

International decision-making on plastic pollution is set to continue in the coming months. In February 2026, INC-5.3 session is scheduled with a focus on the election of officers including for the position of Chair. Regarding the Plastics Treaty itself, the seventh session of the UN Environment Assembly (UNEA) will take place in Nairobi, Kenya, in December 2025. The meeting will give governments the opportunity to discuss the way forward for any Treaty or further action. UNEA is the highest-level decision-making body of the UN Environment Programme, and was responsible for adopting the initial resolution to end plastic pollution. The upcoming session may determine the future of any negotiations on the Treaty.

Between December 2024 and August 2025, InfluenceMap detected engagement from 42 companies and 21 industry associations on the UN Global Plastics Treaty, with engagement particularly strong from the consumer goods, retail, chemical and petrochemical sectors. A total of 62 corporate communications were identified in the run-up to and including INC-5.2. Of these, 27 communications were positive, 22 were negative, and 13 were neutral positions or unclear. Positive engagement came from 39 companies and industry associations, 36 of which are members of the Business Coalition for a Global Plastics Treaty. InfluenceMap found evidence of only eight of the 36 Coalition members engaging in direct positive advocacy (advocacy that was independent from the Coalition). This suggests that while the Coalition plays an important convening role, most members have not yet translated their stated support into consistent, proactive, and public engagement themselves.

Supportive advocacy was concentrated in the consumer goods and retail sectors, accounting for more than two-thirds (67%) of positive communications. These companies and associations consistently promoted an ambitious, legally binding Treaty that covers the entire life-cycle of plastics. Their positions emphasized alignment with the waste hierarchy, stronger extended producer responsibility (EPR) schemes, phase-outs of problematic and avoidable materials, as well as binding provisions on product design. The remaining 33% of positive advocacy originated from a range of sectors including healthcare, financial and industrial sectors.

Positive entities include Unilever, Danone, Nestlé, Coca-Cola Europacific Partners, LEGO and Carrefour, with limited positive engagement detected from industry associations. These entities along with 30 others on the LobbyMap database are members of the Business Coalition for a Global Plastics Treaty, which has consistently advocated for an ambitious and legally binding Treaty that covers the life-cycle of plastics, including supporting the phase out of chemicals of concern under a legally binding obligation. (Findings from InfluenceMap’s previous analysis in November 2024 also indicated positive advocacy on the Treaty from this coalition and its members in the consumer goods and retail sectors). At least 13 Coalition member organizations had representatives present in Geneva, with a total of 24 representatives on the ground, according to the UNEP participants list.

Borealis, a chemical company and OMV subsidiary, was among the few chemical sector entities that actively supported the Treaty. Other chemical companies, such as Dow, expressed general support but were also linked to less supportive communications, as detailed below.

Following the collapse of the INC-5.2 negotiations in August 2025, the Business Coalition for a Global Plastics Treaty and its members such as Unilever, Nestlé and PepsiCo have continued to be vocal in their support of continuing talks, and building on the progress made from negotiations to implement harmonized regulations on elements including phase-outs, product design, and EPR. The seventh UNEA session in December 2025 will likely be a key moment for deciding whether to move forward with Treaty negotiations.

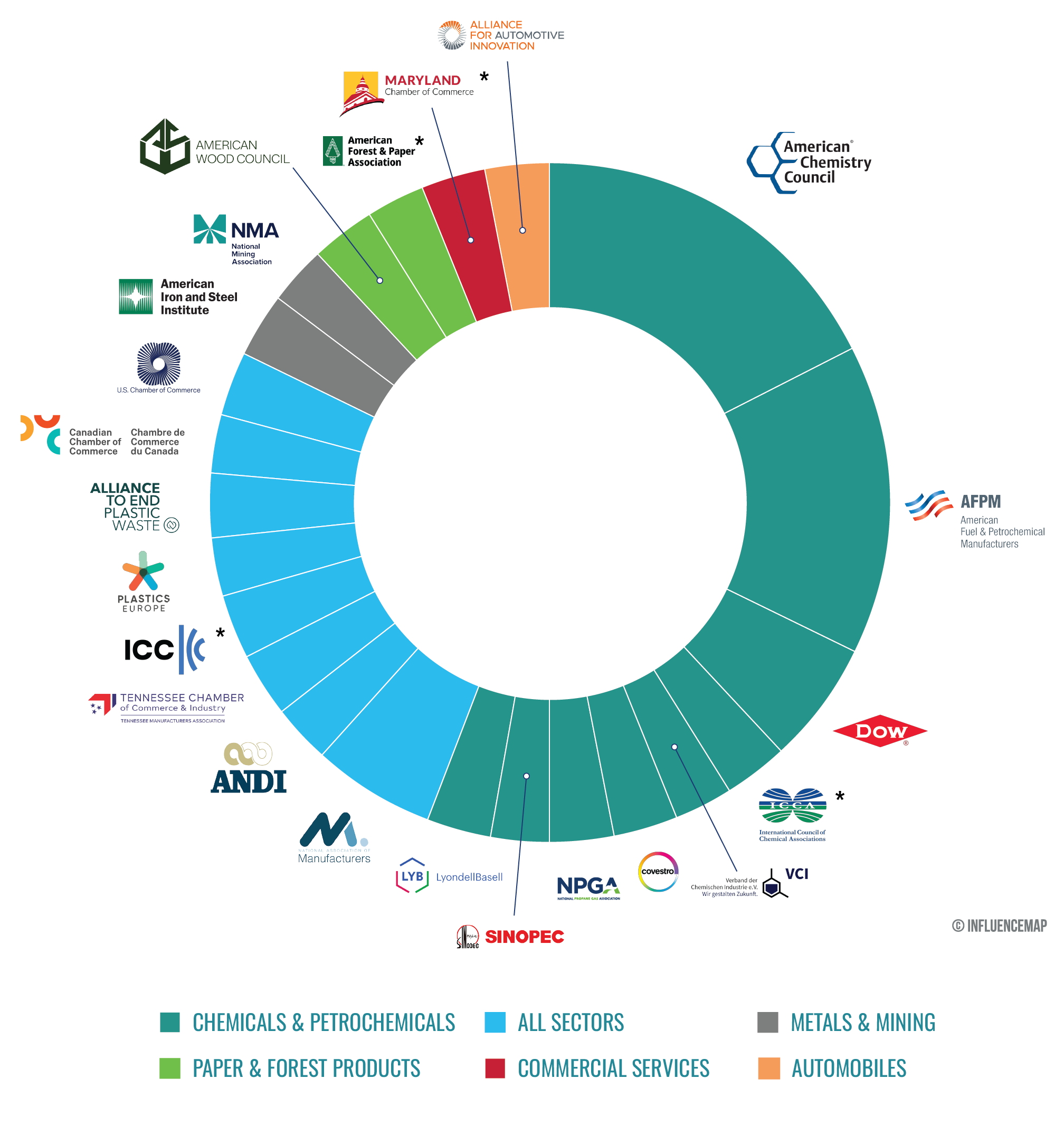

Opposition to an ambitious Global Plastics Treaty was detected from 23 companies and industry associations, primarily in the chemical and petrochemical sectors, which accounted for 56% of negative advocacy, as shown in the figure below. Cross-sector industry associations contributed 26%, and the remaining 18% originated from metals, mining, paper, and forest products sectors, as shown below. According to the UNEP participants list, at least 26 representatives from eight of these companies and associations were present in Geneva.

Figure 1: Negative Advocacy on the UN Global Plastics Treaty by Sector Between December 2024 and August 2025

Specific areas of negative advocacy included opposition to caps or limits on plastic production, prioritizing downstream measures such as recycling over reduction, advocating for a narrower Treaty scope that excludes chemicals, and calling for flexibility based on national circumstances.

Industry associations were particularly active in opposing the Treaty. A total of 19 associations were found to take negative positions on the Treaty, with more than 41% of negative advocacy originating from only five industry associations in the chemical and petrochemical sectors—American Fuel & Petrochemical Manufacturers (AFPM), the American Chemistry Council (ACC), the German Chemical Industry Association (VCI), the National Propane Gas Association (NPGA), and the *International Council of Chemical Associations (ICCA).

AFPM, ACC, and VCI all submitted multiple communications promoting a less ambitious Treaty.

ACC was a signatory of two joint letters advocating directly to the Trump administration in December 2024 and July 2025, advocating against measures targeting production of plastics, and calling for the adoption of national flexibility.

AFPM also signed the July 2025 letter.

Beyond these five highly active groups, cross sector industry associations with chemical and petrochemical interests including Plastics Europe and the Alliance to End Plastic Waste, whose members include ExxonMobil, TotalEnergies, and Shell, also advocated against an ambitious agreement.

The Alliance to End Plastic Waste promotes a vision “to end plastic waste entering the environment and to create circular systems that keep materials and products in use for as long as possible.” However, despite its top-line messaging, the organisation does not promote ambitious positions on plastics. It advocated to weaken the ambition of the Treaty by promoting national flexibilities and suggested a “practical and implementable instrument.”

Companies demonstrating negative direct engagement with the Treaty included Dow, LyondellBasell, Covestro, and China Petroleum & Chemical Corporation (Sinopec). Dow reportedly advocated for a narrower scope to the Treaty along with Covestro, similar to that of their industry association VCI. All these companies took unsupportive positions on measures to cap or limit production of plastics, calling instead for the prioritization of downstream measures to reduce plastic waste, including recycling.

Negative advocacy since the end of the fifth session of negotiations is mostly consistent with InfluenceMap’s previous analysis in November 2024. AFPM, ACC and Dow have persisted in their negative advocacy and carried the same arguments into August 2025. On the other hand, a wider range of sectors including cross-sector associations, metals, mining, paper, and forest products sectors have emerged in opposition to the Treaty.

Continued and significant opposition from U.S. based chemical and petrochemical companies and industry associations is consistent with the reported position taken by the U.S. delegation, which has distributed memos to other nations outlining that it will not endorse a treaty targeting upstream plastic pollution.

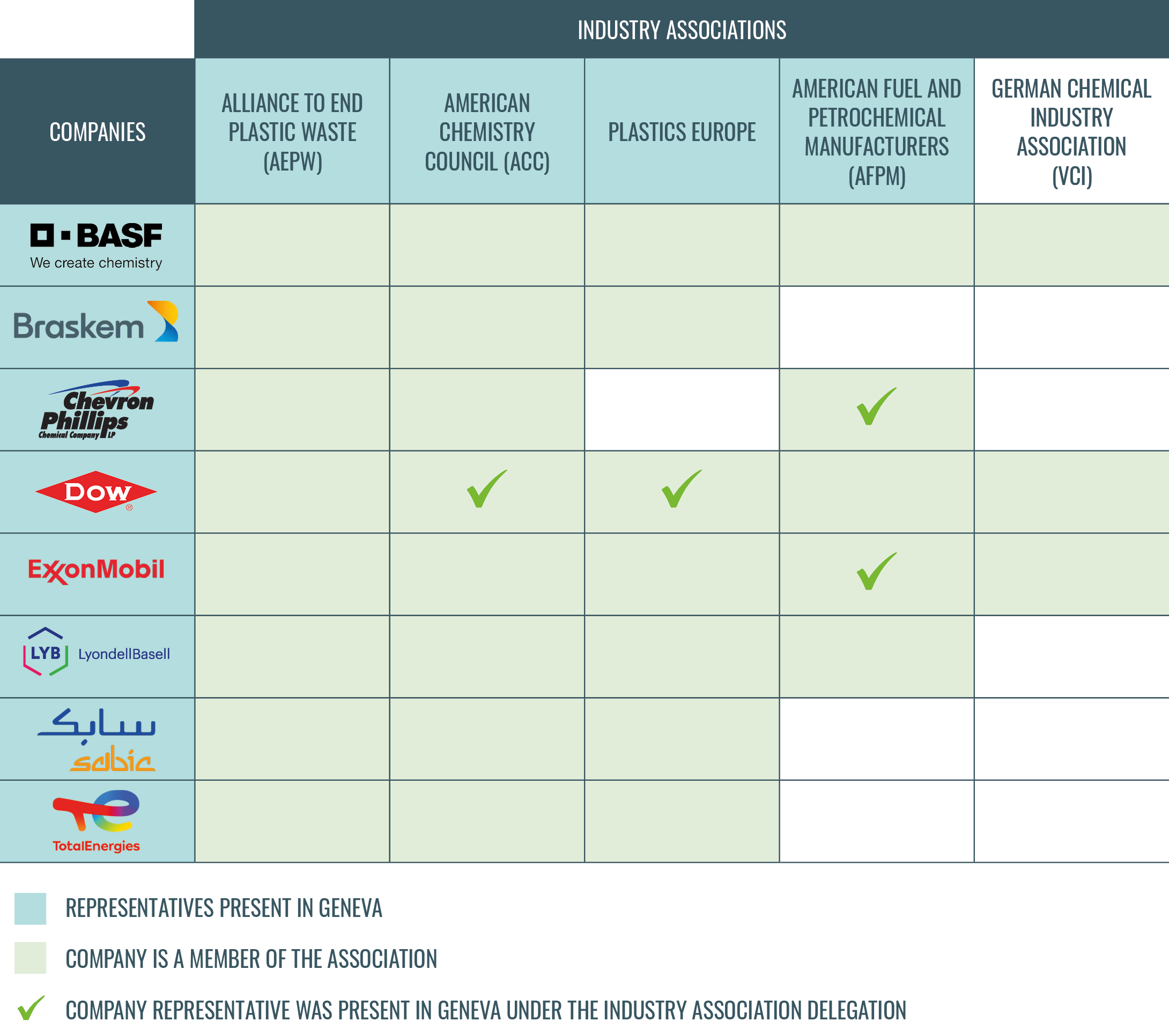

For a deeper understanding of the links between negative actors, the table below provides an overview of companies that are members of the Alliance to End Plastic Waste and have either engaged on the Treaty since INC-5.1 or participated in the Geneva negotiations. It also details their memberships in other key negative industry associations representing chemical and petrochemical interests and their participation on behalf of these associations in Geneva.

Table 1: Industry associations with unsupportive positions on an ambitious UN Global Plastics Treaty, their presence at INC 5.2 along with key company memberships

Since the end of negotiations in August, associations including the American Chemistry Council (ACC), the Alliance to End Plastic Waste, and Plastics Europe have expressed their general support for continuing work towards a Treaty. However, this support is accompanied by continued advocacy for prioritizing downstream measures, including recycling, over the reduction of plastic use in communications from the President of Plastics Europe and the CEO of ACC. Continuing this advocacy in the run up to the seventh UNEA session in December 2025 will risk further obstruction to the implementation of an ambitious, Global Plastics Treaty.

The analysis shows that most of the positive corporate engagement with the Treaty was channeled through the Coalition. However, InfluenceMap identified only 5 distinct instances of public engagement by the Coalition on the Treaty between INC 5.1 (December 2024) and INC 5.2 (August 2025). This is compared to 17 engagements from 19 different industry associations pushing against the treaty. This comparison illustrates that the relatively few supportive interventions are being outweighed by a broader and more sustained pattern of negative engagement.

The limited impact that positive corporate voices have had on the negotiations so far might also point to internal challenges within such coalitions in fostering broad, cross-sector agreement on key positions and narratives. Notably, 21 companies that are part of the Coalition are also members of one or more industry associations that engaged negatively on the Treaty, including 3M, PepsiCo, Coca-Cola, Novo Nordisk, Uber and Walmart. This suggests that some companies that are directly supporting a binding Treaty on plastic pollution are also indirectly contributing to efforts to weaken it.

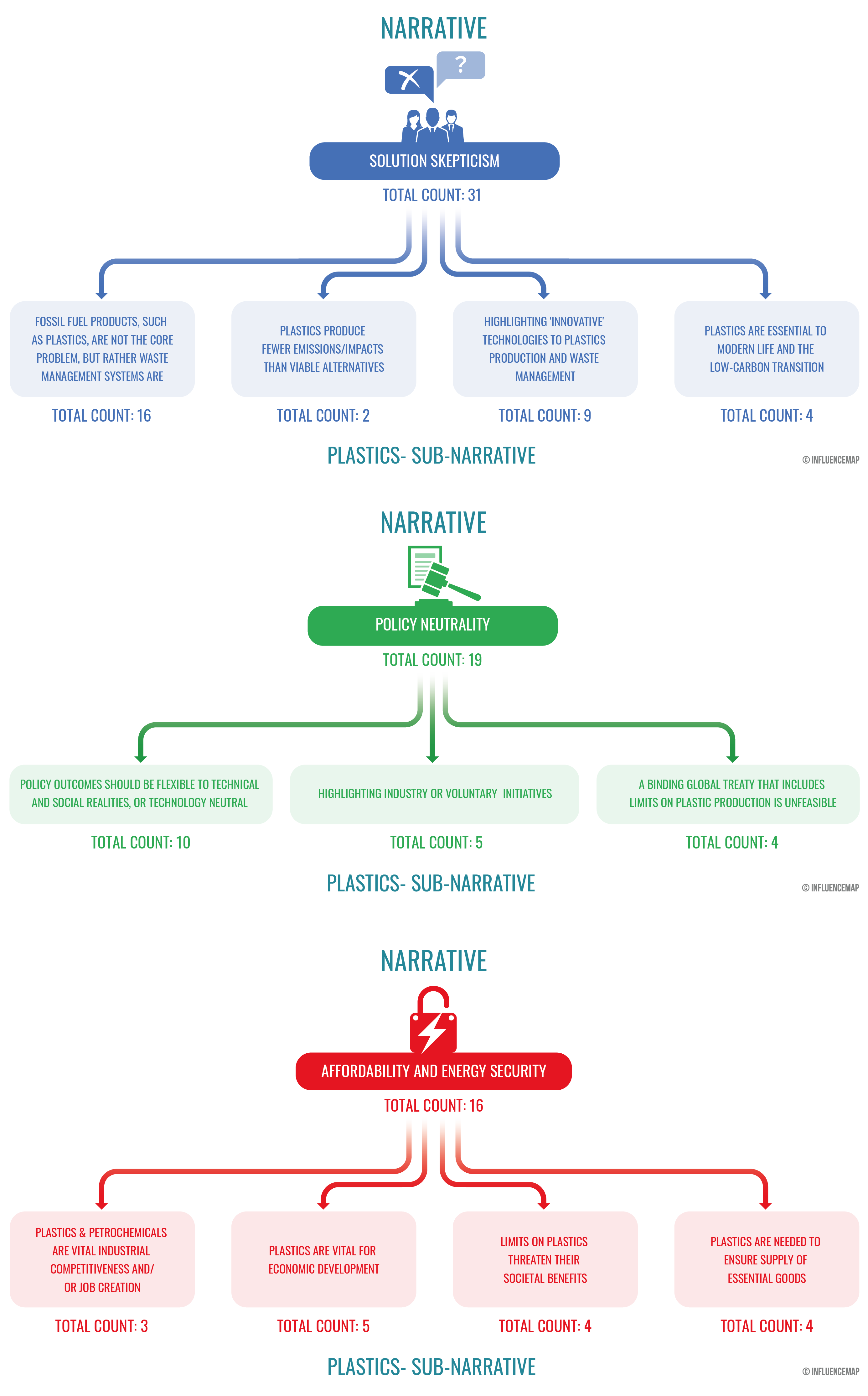

Analysis of unsupportive corporate engagement with the UN Plastics Treaty since the conclusion of INC-5.1 in December 2024 reveals a common playbook of narratives and arguments typically cited by the fossil fuel industry. InfluenceMap’s July 2024 report “How the Oil Industry Has Sustained Market Dominance Through Policy Influence” identified three broad types of fossil fuel industry narratives often used to delay or weaken the shift from fossil fuels to clean energy. These are:

Solution Skepticism: Downplaying the impact and viability of alternative energy sources and infrastructure, to undermine the potential of cleaner energy in communications to policymakers.

Policy Neutrality: Opposing policy that promotes solely alternatives to fossil fuels, and calling instead for consumer choice, market solutions, and minimal government intervention.

Affordability and Energy Security: Stressing the importance of maintaining cost-effective and secure energy supplies. Fossil fuels are presented as central to both causes, while a shift to technology alternatives is framed as a significant risk.

The same narrative structures are now being adapted to the plastics debate. Rather than focusing on energy, they are being used to argue against an ambitious global Treaty that would place limits on plastic production and consumption.

Overall, corporate entities used one of the three narratives named above 66 times across the 35 instances of negative advocacy identified between December 2024 and August 2025 (which includes advocacy that was unclear, or that took a mix of positive and negative positions).

The most common narrative in negative corporate advocacy on the Plastics Treaty is Solution Skepticism, with 31 cases identified. Here, industry groups pushed alternative solutions to production limits. The most frequent claim (16 cases) was that limits to waste management solutions, such as recycling, rather than plastics production, is the core problem. Other arguments included positioning “innovative technologies” as the answer or presenting plastics as essential to modern life and the energy transition.

Policy Neutrality was the second most common narrative, appearing in 19 cases. This typically took the form of calls for a “flexible” approach rather than binding production caps. Examples included arguments that policy should reflect “national circumstances” or be “technology neutral,” promotion of voluntary industry initiatives (5 cases), and questioning whether an ambitious Treaty is realistic.

Affordability & Energy Security appeared 16 times. Here, plastics were framed as vital for economic development, trade, and access to essential goods, with claims that production limits would harm social benefits or undermine regional economic growth.

Figure 2: Fossil fuel narrative playbook, highlighting the adapted plastic-specific narratives employed to oppose an ambitious Plastics Treaty

In its 2022 Mitigation of Climate Change Report (AR6), the Intergovernmental Panel on Climate Change (IPCC) stated that “projections for increasing plastic production as well as petroleum use, together with the lack of investments in breakthrough low-emission technologies, do not align with necessary emission reductions” to limit temperature rise to 1.5°C (AR6, WG3, April 2022, Chapter 11, P. 1194). The IPCC also states that “the implementation of a circular economy relies on the operationalization of the R-imperatives or strategies which extend from the original 3Rs: Reduce, Reuse and Recycle” and that “The R - implementation strategies are diverse across countries … but, in practice, the lower forms of retention of materials, such as recycling and recover (energy), often dominate. The lack of policies for higher retention of material use such as Reduce, Reuse, Repair and Remanufacture is due to institutional failures, lack of coordination and lack of strong advocates” (AR6, WG3, April 2022, Chapter 11, P. 1220). In its 2014 Synthesis Report (AR5), it suggests that for mitigation in waste management, waste reduction should be “followed by re-use, recycling and energy recovery (robust evidence, high agreement)” (AR5, WG3, October 2014, Chapter 4, P. 102).

Reports indicate that these narratives have played a key role in the negotiations with examples detected in communications from nations present in Geneva. For example, Saudi Arabia has argued that “restricting use of plastics or their production should not be in the scope of the agreement” and that the agreement should recognize the “importance of plastics to achieve sustainable development goals”. Russia formally proposed to exclude “primary polymer production” from the Treaty’s scope, both shifting responsibility away from production. The United States stressed the “important role played by plastics in human society” and called for approaches based on “national circumstances and capabilities.” India, Iran and Malaysia were also reported to reject any measures on plastic production.

Overall, the arguments used by unsupportive entities are consistent with strategies historically used by the fossil fuel industry to slow the transition away from fossil fuels. Their appearance in the Plastics Treaty debate reflects a pattern of delay tactics, including shifting responsibility away from production, emphasizing technological solutions, and portraying global binding rules on production as impractical or harmful. While these positions may appear constructive, they tend to divert attention from the most effective measure on the table– in this case, reducing plastic production and consumption. Continued use of these narratives in further negotiations or decision-making processes risks further delaying the implementation of an ambitious and legally binding Global Plastics Treaty.