This research aims to understand the impact companies in the LNG industry are having on government policy to mitigate climate risks in Japan and Australia. It was developed by InfluenceMap’s teams in Japan, Australia, and the UK, and has been informed by engagement and feedback from industry, policymakers, NGOs, and research stakeholders in Japan and Australia. This page presents a summary of the findings, along with key graphics and supporting quotes. The full report and press release can be downloaded using the links below.

New InfluenceMap analysis explores how a network of fossil fuel companies and industry associations across Japan and Australia is working to influence government policy on the role of liquefied natural gas (LNG) to expand Australian LNG exports and increase reliance on fossil gas in parts of Southeast Asia.

This research, which includes analysis of more than 2,000 data points on corporate and industry policy engagement, was developed with engagement and feedback from industry, policymakers, NGO, and research stakeholders across both regions. Parts of the research were presented in testimony to the Australian Senate Select Committee on Information Integrity on Climate Change and Energy in September 2025.

The analysis indicates that several Japanese fossil fuel companies, including INPEX, JERA, Mitsubishi, and Mitsui, have a significant financial presence in Australia’s LNG industry, holding more than USD 50 billion in equity across 13 export projects, equivalent to nearly 17% of global LNG export capacity. If these projects maximize their potential output, they would produce annual CO₂ emissions of around 290 million tonnes1, a figure comparable to the total annual emissions of countries such as Malaysia, Taiwan, and the Philippines.

In Japan, fossil fuel companies and their industry associations have a substantial presence in formal energy and climate policy processes, with major trading houses, utilities, and gas associations, including Mitsubishi, Tokyo Gas, and Japan Gas Association, holding around 69 positions on key climate and energy policy committees.

In Australia, Japanese companies have engaged with government energy policy through a combination of private meetings with senior government ministers and participation in industry groups, including the Australian Energy Producers, Business Council of Australia, and Minerals Council of Australia. These associations dominate submissions to federal government consultations on energy and climate policy, consistently arguing that new gas supply is essential for energy security and that stronger climate regulation would harm competitiveness.

These companies and industry groups reinforce these policy engagement activities using pro-fossil fuel narratives, which have also permeated policymakers' language. Industry framing of gas as a transition solution in Japan and as essential for affordability and energy security in Australia is repeatedly reflected in official communications, despite being misaligned with guidance from Intergovernmental Panel on Climate Change (IPCC) on the measures needed to deliver the Paris Agreement's goal of limiting global temperature rises to well below 2°C and as close to 1.5°C as possible.

Company logos are occasionally utilized in the graphics of this report, as is common practice in public facing releases of this kind. Logos and other identifying marks associated with organizations are reproduced for factual, public-interest purposes in line with basic international legal principles on Fair Use and do not imply endorsement, authorisation, or permission from the entities concerned.

Please note, the figure on p. 12 in the full, downloadable report was updated on 9/2/2026 to correct a typo in the dollar figures for investment. Please use current graphic for any reproduction.

Disclaimer: The volumes are estimates. Australian LNG used for domestic use in Japan is estimated as the total volume of Australian LNG shipments going to Japan. Volume of re-sale includes Japanese chartered shipments sold to third countries and estimated seller-chartered shipments resold by Japanese companies through spot sales and contracts. 1 Mt of LNG is calculated as 55.4 PJ of gas. “Handling volume” is defined as “the LNG volume that is possessed, even temporarily, by Japanese companies for procurement or sales”. (JOGMEC) The figure for the total handling volume is from the fiscal year 2023 (Apr 2023-March 2024). Source: JOGMEC, IEEFA. In this context, “investment” covers initial project costs up to the start of operations (hence ‘CAPEX’) and excludes ongoing operational costs. Total flow of investment was estimated by multiplying project CAPEX by the % owernship stake of companies included in this analysis.

The recent heatwave and destructive fires across Victoria present a stark reminder of what’s at stake if we continue approving new coal and gas projects. In spite of the clear scientific consensus to reduce climate pollution, we’re constantly told we need new gas development because of shortages in Australia’s east coast gas market. The reality is that over 80% of Australia’s gas is directed overseas. We don’t have a gas supply problem; we have a gas export and corporate lobbying problem.

InfluenceMap’s analysis goes some way to explaining why the Australian government continues to act as an enabler, allowing Japanese gas companies to profit from the resale of Australian gas at the expense of Australian households and businesses. The Australian government’s ongoing support for fossil gas expansion reflects its susceptibility to the relentless lobbying of Japanese gas interests. It reinforces the need for more transparent regulation of corporate lobbying, and for the Australian government to act in the best interests of its citizens rather than those of Japanese companies and their industry associations.

This incredible report demonstrates the significant, and insidious, influence the gas industry and the Japanese government has over Australian climate policy. Decades of corporate lobbying has sabotaged climate action and delayed the transition to a sustainable, green future both here in Australia and across Asia.

We have seen a steady campaign of misinformation from the fossil fuel industry, promoted blindly by the Australian and Japanese governments, claiming that gas will help the region decarbonise. But, the truth is that the ongoing export of WA LNG risks slowing decarbonisation efforts across Southeast Asia by crowding out investment in renewables. Research commissioned by the Western Australian government and released last year made this abundantly clear, despite their best efforts to hide it from the public eye.

No matter how hard they try to spin the facts, the gas industry and the Australian and Japanese governments cannot hide the truth that gas is anything other than a dangerous fossil fuel. Rather than caving to pressure from the fossil fuel industry, governments across Australia must do more to accelerate our transition away from fossil fuels and, in doing so, put the interests of Australian households and businesses ahead of corporate profits.

With support from the Japanese government, Japanese fossil fuel companies and trading houses have invested large sums not only in coal but also in the exploration, development, and production of natural gas, generating substantial profits, including through resale to other countries. The scale of these investments is much greater than that of other advanced economies.

These activities have drawn criticism—primarily from overseas NGOs and think tanks—because they make it almost impossible to achieve the Paris Agreement’s 1.5°C target. However, within Japan, such criticism has largely been drowned out by the narrative promoted by the government and corporations that “natural gas is indispensable for decarbonization.” As a result, many members of the public do not recognize that this narrative is misleading and constitutes greenwashing by the Japanese government and corporations.

InfluenceMap’s report specifically demonstrates how the Japanese government and corporations have worked together to exert negative influence not only in Japan but also on climate policies in Australia and other Asian countries, in ways that delay decarbonization.

This research highlights the extraordinary influence Japanese gas corporations have on Australian governments, particularly given how little Australians get in return. INPEX exports vast amounts of Australian gas to Japan every year, and the Australian Government gives them all that gas for free. They also pay little if any corporate or petroleum tax on billions of dollars’ worth of sales of Australian gas and face virtually no consequences for serious pollution breaches. Our elected representatives should remember their job is to represent the interests of Australians, not give our resources away to ingratiate themselves with foreign gas corporations.

Japan is the largest provider of public finance for fossil gas projects in Australia, while Australia is one of the world’s three largest LNG exporters, with Japan as its key market. Although commonly justified under the guise of energy security, declining gas demand in Japan and growing resales of Australian LNG by Japanese companies are calling into question the strategic rationale underpinning Japan and Australia’s ongoing LNG relationship.

This report combines project-level financial data with analysis of corporate climate policy engagement to identify a four-part playbook used by Japanese companies and their industry associations to secure support for fossil gas expansion in Japan and Australia and prolong the role of fossil gas in the wider Asia-Pacific region. In practice, these parts do not represent a neat set of sequential moves, but an interdependent group of actions that are equally significant in shaping the direction of climate and energy policy in ways that prolong the role of fossil gas in the wider Asia-Pacific region.

Japanese companies play a central role in Australia’s LNG industry. InfluenceMap analysis of Global Energy Monitor data shows that Japanese companies are involved in 13 major Australian LNG export projects, making up nearly 46% of all corporate participants. Japanese companies have invested approximately USD 52.6 billion, or 21.6% of the total USD 242.9 billion invested across these projects, linking Japanese corporate interests directly to Australia’s gas export economy. Based on projected output, these projects could be associated with annual CO₂ emissions of around 290 million tonnes, a figure comparable to the total annual emissions of countries such as Malaysia, Taiwan, and the Philippines.

In this context, “investment” covers initial project costs up to the start of operations (hence ‘CAPEX’) and excludes ongoing operational costs. The report assumes that CAPEX costs are allocated in proportion to the equity stakes held by each project investor. Total investment was estimated by multiplying project CAPEX by the % owernship stake of companies included in this analysis.

The interactive map below provides detailed information on these projects and the companies involved. Use the toggles to filter for the type of project and click on the circles for information on each company’s equity stake in each project.

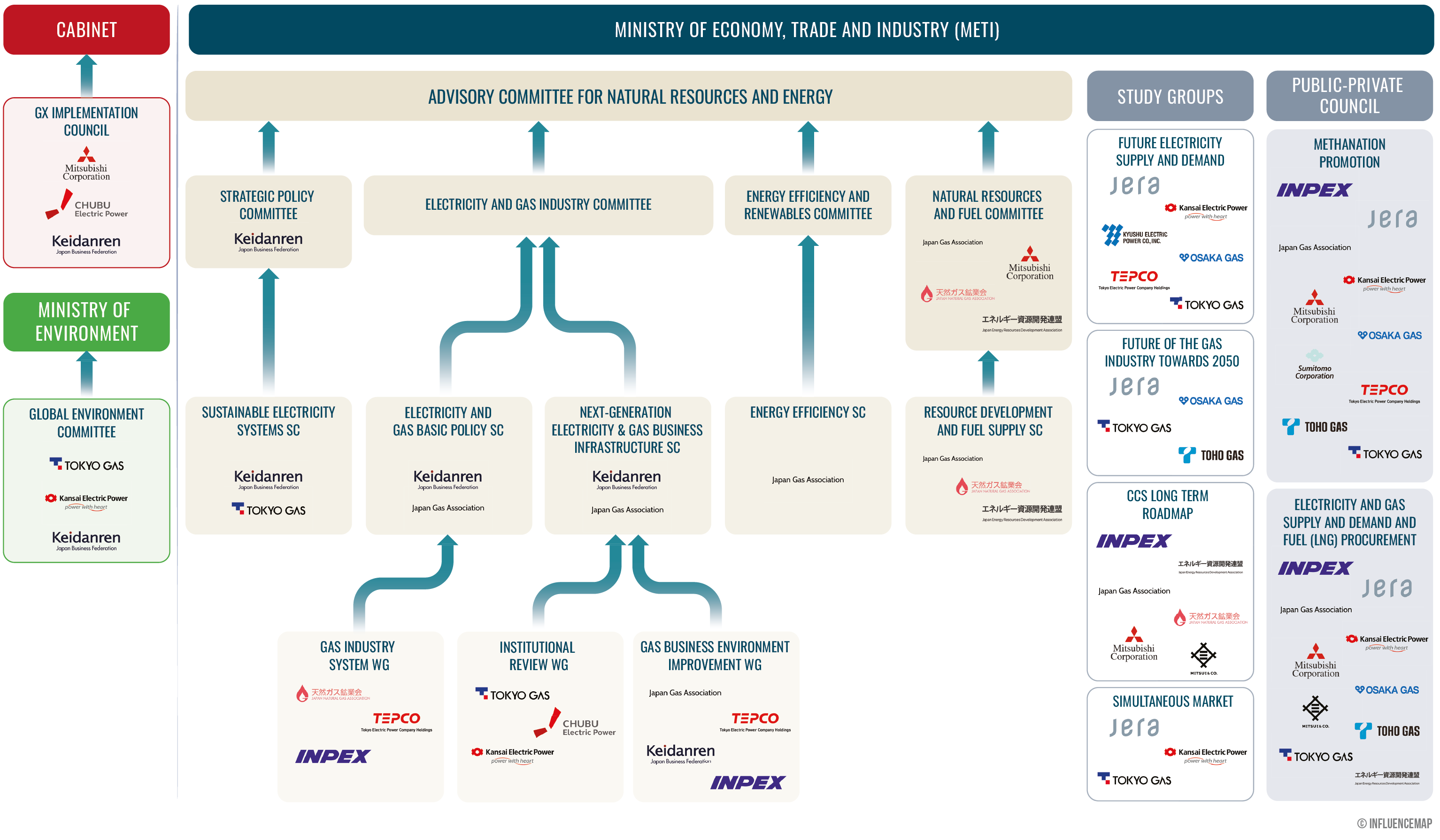

Major Japanese fossil fuel companies, trading houses, and industry associations hold important positions on key government committees, giving them direct access to energy and climate policymaking. Japanese companies with equity in Australian LNG projects included in this research, alongside their industry associations, hold at least 69 seats on key government committees under Japan’s Ministry of Economy, Trade and Industry (METI), Ministry of the Environment, and Cabinet. Figure 4 below maps participation by these 13 companies and their industry associations across these committees, highlighting how corporate actors with direct financial interests in fossil fuel expansion maintain privileged access to climate policy decision‑making.

Disclaimer: Figure 4 provides a simplified version of the committee structure and committee membership for illustrative purposes. Source: METI

This policy influence has helped embed a long-term role for LNG in Japan’s 7th Strategic Energy Plan, which reaffirms the METI’s 100 Mt per year LNG “handling” target for Japanese companies, despite projecting that domestic LNG demand will fall to 53–61 Mt by 2040. This implies that 39–47 Mt of LNG will be available for third‑country sales. These resales, which reached 38 Mt in FY2023, have more than doubled since FY2018, generating more than AUD 1 billion in profits for Japanese companies. This trend challenges claims by Japanese and Australian corporates and government officials that Australian LNG is required to ensure Japan’s energy security. A thorough analysis of industry influence on the 7th Strategy Energy Plan is provided in Table 2 (pp. 18-19) of the full report, which can be downloaded above.

Maintaining a favorable policy environment for continued fossil gas production and export in Australia is a central component of corporate Japan’s strategy to export fossil gas dependence across Southeast Asia. Japanese companies advance this agenda through private meetings with Australian ministers and officials and via Australian industry associations that lobby intensively on their behalf.

Despite weak federal transparency rules around lobbying in Australia, InfluenceMap’s analysis of freedom of information (FOI) documents shows that Japanese companies involved in LNG projects in Australia have met privately with Australian Cabinet ministers and officials at least 24 times since the Labor Government’s election in May 2022. These documents demonstrate that Japanese LNG companies have had direct access to Australian government officials and highlight the sector’s potential to influence policymakers' positions.

For example, previously unseen FOI documents reveal that INPEX and JERA secured private meetings with the Department of Industry and the Department of Climate Change in July 2025 to “address concerns” about Japanese on-selling of Australian LNG. INPEX and JERA highlighted Japan’s Strategic Buffer LNG (SBL) policy as justification for oversupply and on-selling, arguing that they were acting in line with government expectations. InfluenceMap analysis indicates that INPEX and JERA lobbied in favor of the SBL framework before its introduction, suggesting that corporate advocacy helped create the policy now cited as neutral context.

Additional FOI documents relating to Resources Minister Madeleine King’s October 2024 visit to Japan further show that a central objective of her bilateral meetings with Japanese companies was to provide assurances on continued LNG supply.

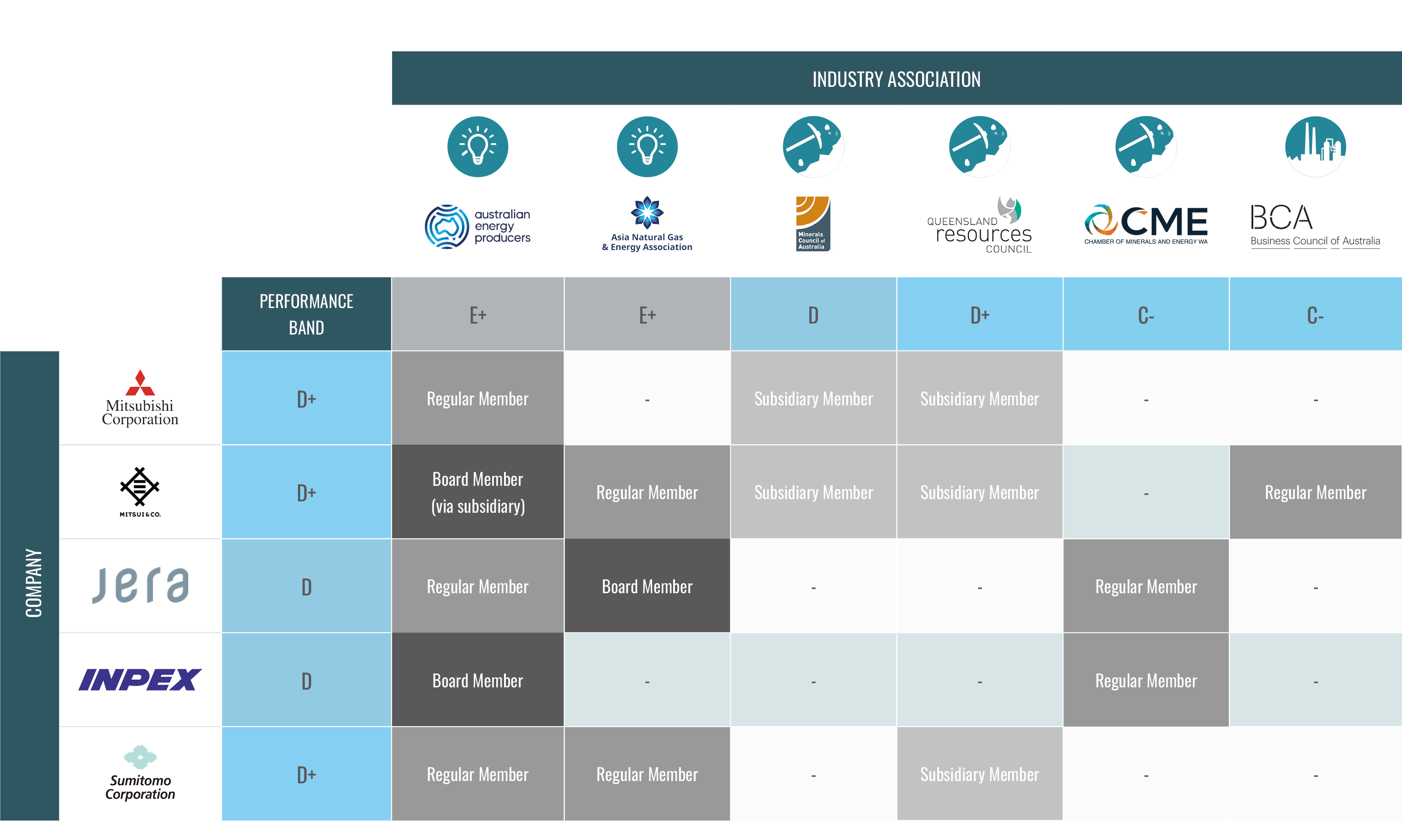

Japanese companies also appear to rely heavily on industry associations to advance their interests in Australia, allowing them to shape policy indirectly. Table 1 (below) maps the relationships between Japanese companies with stakes in Australian LNG projects and key industry associations that are actively engaged in Australian climate policy, including the Australian Energy Producers (AEP), Business Council of Australia (BCA), and Minerals Council of Australia (MCA). These memberships link Japanese corporate interests to a broader pro‑gas coalition that also includes Woodside, Santos, Shell, Chevron, ExxonMobil, and BP.

Note: The membership categories in this table have been summarized. For information on the nuances in each company's role within these associations, please consult the company profiles in the LobbyMap database.

Australian industry associations also lead engagement via formal climate and energy policy consultations for their members. InfluenceMap analysis indicates that, across nine major federal climate and energy-related policy consultations since 2022—including the Future Gas Strategy, Safeguard Mechanism reforms, Gas Market Review, and Nature Positive reforms—associations such as AEP, MCA, BCA, Chamber of Minerals and Energy of Western Australia (CME), Queensland Resources Council (QRC), and Asia Natural Gas and Energy Association (ANGEA) commonly repeated two arguments:

Individual responses to the energy-related consultations (shown in Table 2 below) were assessed against InfluenceMap’s Science-Based Benchmarks to determine the degree of alignment with the IPCC’s 1.5°C-aligned guidance on fossil gas. See InfluenceMap’s Australia Policy Tracker page here for a more detailed breakdown of corporate engagement across all nine consultations. A detailed analysis of industry influence on Australian climate policy is provided in Table 5 (pp. 25-26) of the full report, which can be downloaded above.

Pro-LNG actors in Japan and Australia use complementary narratives that reinforce each other to build support for fossil gas expansion across the region. In Japan, gas is framed as a technical solution for decarbonization, and in Australia, as an economic and social necessity, allowing these actors to present LNG as compatible with climate goals in both markets.

InfluenceMap has found these narratives to be misaligned with guidance from the Intergovernmental Panel on Climate Change on policy pathways needed to reduce GHG emissions in line with the Paris Agreement's goal of limiting global temperature rises to well below 2 °C and as close to 1.5°C as possible.

InfluenceMap’s July 2024 “Fossil Fuel Narrative Playbook” identified three broad narrative categories commonly used to oppose, weaken, or delay the energy transition: affordability and energy security; solution skepticism; and policy neutrality. Figure 5 compares the use of this narrative playbook in Australia and Japan.

Narrative influence extends beyond public messaging into policymaking itself. Analysis of over 200 pages of previously unseen briefing documents, obtained via FOI requests related to Australia’s Resources Minister’s October 2024 visit to Japan, shows repeated use of industry-aligned language. Terms such as “energy security,” “reliable energy,” “affordable energy,” “CCS,” and “technology neutral” appear throughout official correspondence, closely mirroring fossil fuel industry framing. For a detailed analysis of how industry narratives can be traced to language in subsequent statements by senior policymakers in both Japan and Australia, please refer to Tables 6 and 7 (pp. 29-30 ) in the full report, which can be downloaded above.

In the face of extensive engagement from Japanese and Australian oil and gas interests in favor of expanded fossil gas supply, a growing group of companies and industry associations in both countries is challenging the prevailing narrative and advocating for science‑aligned energy transition policies. In Japan, the Japan Climate Leaders’ Partnership has called for a target of 60% renewable energy by 2035 in the 7th Strategic Energy Plan, while the Japan Climate Initiative has proposed an even higher range of 65–80%. In Australia, corporate leadership for a rapid shift to renewables and accelerated fossil fuel phase-out is led by companies such as Fortescue and Atlassian, and by clean energy and automotive associations including the Smart Energy Council, Energy Efficiency Council, and Electric Vehicle Council.

1The combined export capacity of seven major LNG terminals—Gorgon, Ichthys FLNG, Wheatstone, North West Shelf, Prelude FLNG, Pluto, and Darwin LNG—totals 83.2 Mtpa, according to data from Global Energy Monitor. Emissions from LNG wereestimated using the Carbon Majors methodology. This methodology applies emissions factors largely derived from Tier 1 default values in the Intergovernmental Panel on Climate Change (IPCC) Guidelines for National Greenhouse Gas Inventories and estimates emissions from LNG combustion as well as four categories of direct production-linked emissions. These estimates cover direct combustion and production-related emissions only and do not include LNG supply-chain energy use, which would increase lifecycle emissions above this baseline. Applied to 83.2 Mtpa of LNG export capacity, this implies around 290 MtCO2 per year.