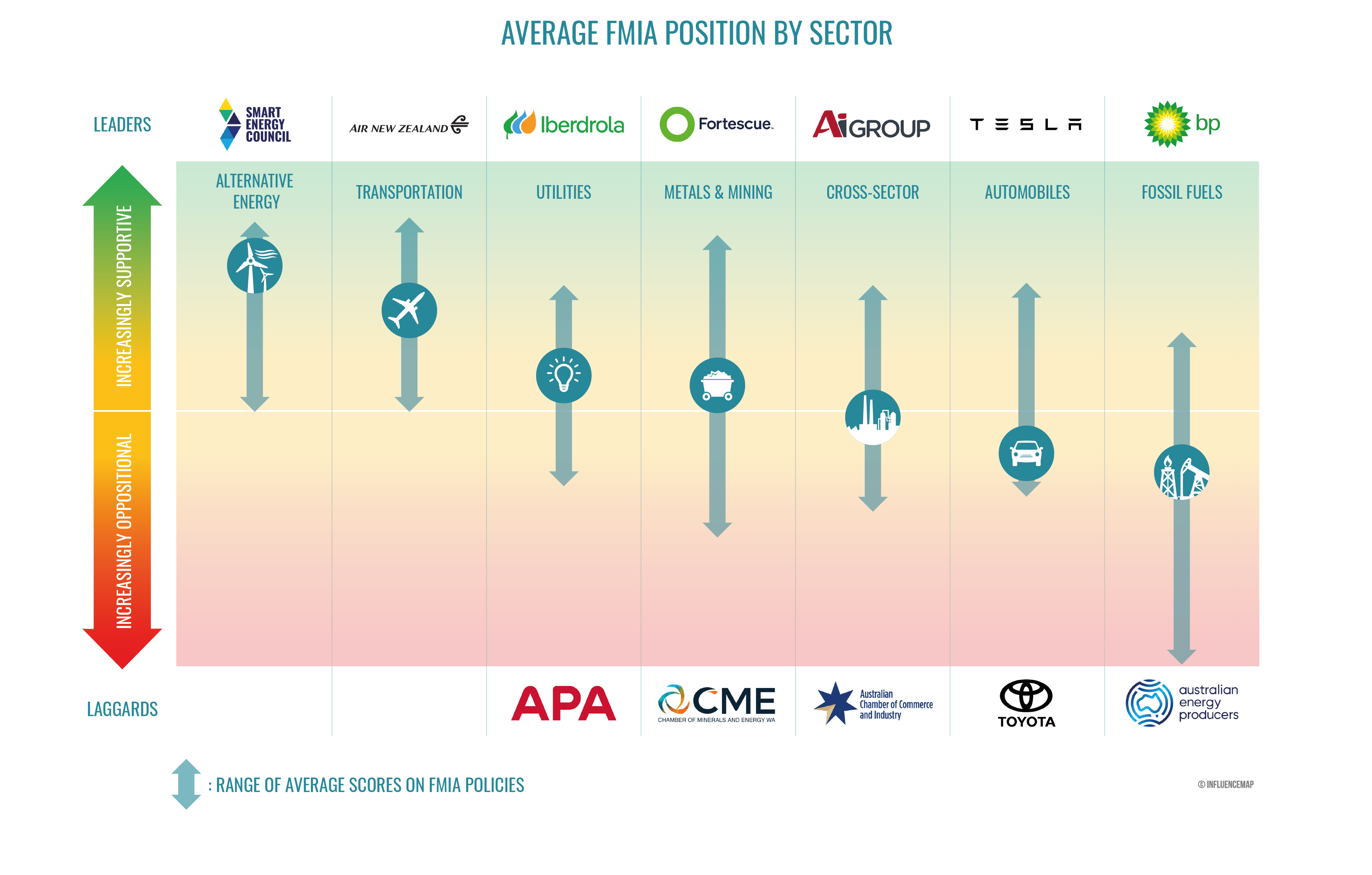

New analysis by InfluenceMap of corporate responses to eight of the key initiatives under the Future Made in Australia plan (FMIA) reveals a growing divergence between obstructive fossil fuel companies and industry associations, and other sectors that are increasingly supportive of the climate measures under the plan.

The briefing analyzes corporate consultation responses to the eight most-engaged-on initiatives proposed under the FMIA, all of which cover either incentives, subsidies, or standards for future energy in Australia (1). For this research, InfluenceMap analyzed 185 responses from the 37 companies and 21 industry associations covered by the LobbyMap platform (2). All of the industry associations are headquartered in Australia, as are 15 of the companies tracked.

Overall, 47.5% of corporate engagement on the initiatives was supportive, and only 25% was actively oppositional—28% of engagement was mixed or unclear. This represents a higher level of support than InfluenceMap observed in its January 2024 report, which found that only 35% of Australia’s leading companies and industry associations advocated supportive positions on federal climate and energy-related consultations during Labor’s first year in office.

Support for the climate initiatives under the FMIA was strong from industries central to Australia’s economy, including metals and mining, transport (excluding automobiles), and utilities—with Fortescue the most positively engaged company. Associations representing the alternative energy sector such as the Australian Hydrogen Council, Clean Energy Council, and Smart Energy Council also engaged positively.

In contrast, the fossil fuel and automotive sectors held mostly negative positions. Australian Energy Producers was particularly negatively engaged across the initiatives under the FMIA, as were, Chevron, ExxonMobil, and Toyota. On average, engagement from major cross-sector industry groups was mixed with some engaging positively, such as Australian Industry Group (AI Group), but others engaging obstructively, like the Australian Chamber of Commerce and Industry. The negatively engaged associations seem to continue to take the “lowest common denominator approach” in their advocacy—aligning their responses with those of their most negative members.

Although both major parties in Australia support the continued use of fossil fuels in some parts of the economy, the current government has advanced a renewables-led approach to decarbonizing some sectors through initiatives such as the FMIA and the Capacity Investment Scheme. In contrast, the federal Liberal/National Coalition has signaled support for a potential pivot to a nuclear-led strategy if elected, as well as plans to expand the FMIA to support fossil fuels.

InfluenceMap analysis detected limited corporate support for the Coalition’s nuclear-led approach compared to the FMIA. Twelve entities in the LobbyMap database responded to the 2024 Inquiry into Nuclear Power Generation: of these, five (42%) supported the inclusion of nuclear power generation, and seven (58%) opposed or expressed concerns with doing so. This is consistent with broader findings on corporate engagement on nuclear energy policy in Australia. Since the Coalition announcement, InfluenceMap has found 37.3% of engagement to be supportive of an increased role for nuclear energy, 53.7% opposed, and 9% unclear.

The research further finds that most of the companies and industry associations that endorsed the introduction of nuclear energy in Australia have policy positions that are otherwise misaligned with science-aligned climate policy (e.g., on the need to phase out fossil fuels) and also took unsupportive positions on the FMIA. Analysis from the Climate Change Authority shows that the nuclear-led path could lead to as much as 2.6°C warming—far above the Paris Agreement target—partly due to extending the role of coal-fired power generators.

Comment from Tom Holen , Program Manager for the Energy Transition at InfluenceMap

While it is positive to see that corporate support for key climate policy extends beyond the clean energy sector, positive companies must also call out the misleading narratives the oil and gas sector continues to use. It is clear that the fossil fuel industry is becoming increasingly isolated in its steadfast opposition to policies that will protect both the physical and economic safety of millions of people in Australia.

Comment from Persephone Fraser, Ethical Research and Climate Policy Lead, Australian Ethical Investments

We know how important limiting warming in line with the Paris Agreement’s goals is for our economy, for our investments, and for our businesses, and we know we will need policy to get us there. It is imperative that businesses engage with climate policy to support the transition and to act in a way which is consistent with their publicly stated commitments. Though there continues to be obstructive lobbying from legacy industries who stand to benefit from delay, it’s encouraging to see this analysis from InfluenceMap which indicates that a growing number of businesses are engaging in support of policies that provide a pathway for Australia to reduce emissions. Now is the time for us to go further, and to ensure meaningful direct engagement from across our economy extends beyond the Future Made In Australia Plan to climate policy in Australia more generally in this critical decade.

Click here for full report and graphics.

Kitty Hatchley, Media Manager, InfluenceMap (London)

Email: kitty.hatchley {@} influencemap.org

(1) This analysis looked at corporate engagement on the Future Made in Australia Bill, the Hydrogen Headstart Program, the review of the National Hydrogen Strategy, the Hydrogen Production Tax Incentive and the Critical Minerals Production Tax Incentive, as well as the consultations on Unlocking Green Metals Opportunities, Unlocking Australia’s Low Carbon Liquid Fuel Opportunity, and Australia’s Guarantee of Origin Scheme. It also assessed engagement on the 2024 Inquiry into Nuclear Power Generation in Australia.

(2) The LobbyMap platform covers 700 of the world’s largest companies and 350 of the largest industry associations globally